Horace and Anders discuss the current uncertainty in the commodities markets and take a look at the logical segments of the adoption curve. Could the conventional wisdom between invention and product in the market be wrong?

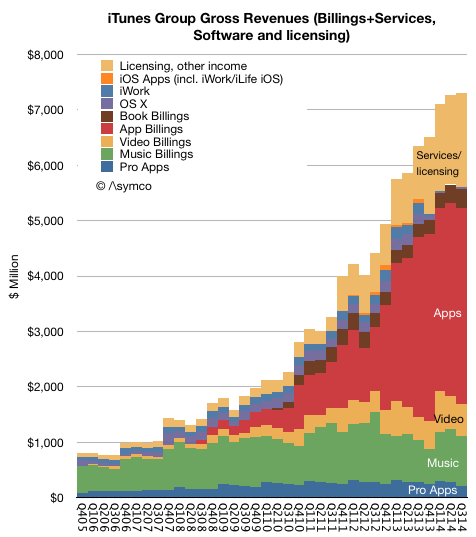

Bigger than Hollywood

Apple paid $10 billion to developers in calendar 2014. Additional statistics for the App store are:

- $500 million spent on iOS apps in first week of January 2015

- Billings for apps increased 50% in 2014

- Cumulative developer revenues were $25 billion (making 2014 revenues 40% of all app sales since store opened in 2008)

- 627,000 jobs created in the US

- 1.4 million iOS apps catalog is sold in 155 countries

Putting these data points together with others from previous releases results in a fairly clear picture of the iTunes/Software/Services1

The App ecosystem billings (what consumers actually pay) is shown in the red area above. 70% of those payments are transferred directly to developers and Apple reports the 30% remaining as part of its revenues. This view of the iTunes ecosystem shows the impact of Apps relative to the other media types. When we measure the payments to the content owners we can see that Apps also dominate: Continue reading “Bigger than Hollywood”

- soon to be renamed Services and encompass everything under the heading of iTunes software and services today including content, apps, licensing and other services and beginning Q4 2014 it will also include Apple Pay. [↩]

The Critical Path #138: The Critical MBA

Horace and Anders discuss this years CES, Apples record $25B in payments to developers as well as the initial installment of the Critical Path MBA. How is business taught in schools? What is a business school graduate optimized to do? Horace explains what one might need to know when considering a business degree.

The Critical Path #137: The Inception

Can we measure the time between inception of an idea and the disruption it later causes in the market? Startups are there to discover a job nobody sees yet but not all laboratory experiments make it to commercialization. Horace and Anders discuss the timing of disruption and look at Bitcoin as an example.

The Critical Path #136: An Interview about The Interview

Moisés Chiullan returns to join Horace Dediu in a discussion of the film “The Interview”. Could the unique circumstances surrounding this film spur a renaissance in content creation in Hollywood?

via 5by5 | The Critical Path #136: An Interview about The Interview.

The Monopolist

When the Apple Watch will begin sales, there will have been dozens of “smart watches” released. At CES this week at least 56 “wearables” were on display. One could be forgiven for thinking that Apple’s Watch will compete with at least that many alternatives. Those alternatives don’t even include the entire existing mechanical and electronic watch market, which, surely, is also filled with competitors.

When analyzing competition, it’s easy to get caught up in one-on-one competitive comparisons, each posited as a decisive life-or-death battle. Consider the list of competitors that Apple has been declared as being in a death-match with:

- Real Networks. Yes, there was a time when Apple’s survival depended on success vs. alternative media encoding technologies.

- Adobe. Remember Flash? No Flash support meant that Apple’s fledgling phone would fail.

- “The Music Industry”. Unhappy partners could surely shut down the iTunes music store, and their insistence on DRM would surely cripple the experience.

- IBM. In nearly every aspect, their business/strategy/inclination and glimmer of intent was an existential threat the Apple.

- Microsoft. In nearly every aspect, their business/strategy/inclination and glimmer of intent was an existential threat the Apple.

- Google. In nearly every aspect, their business/strategy/inclination and glimmer of intent is an existential threat the Apple.

- Samsung. Obviously. But not just phones or tablets. They have control over key components that Apple used in many of its products, before the iPhone even.

- Palm/BlackBerry/Nokia/HTC/Huawei/Xiaomi et.al. Every phone maker (and every phone) was/is an existential threat to Apple.

- Dell/HP/Asus/Lenovo et. al. Every PC maker was a threat to Apple. Some of them made MP3 players. Some of them make tablets.

- Amazon. Obviously. Not only as an iTunes killer but as a device disruptor. They are working on drones, after all.

- Sony. Remember them? No longer a PC maker but they moved in many circles Apple moved in. While we’re at it, add all the consumer electronics companies in Japan.

- Dropbox. “If Apple can’t do iCloud right, they’re doomed”.

This is a very short list (feel free to suggest more) and it becomes clear that the total count of competitors that Apple has to counter “or else” seems to number in the thousands. Practically every hardware, software and service company is positioned as an “Apple Killer”. in fact, the more interesting question might be which companies are not competing with Apple.

Another interesting question relates to why there is no transitive property of competition. I.e. if company A competes with Apple and Apple competes with company B then it does not follow that company A competes with company B.

To wit, whereas HTC competes with Apple and so does Dropbox, it does not follow that HTC competes with Dropbox. So it’s entirely possible that it’s axiomatic that

“Most companies compete with Apple but few of them compete with each other”.

Recognizing a pattern, one could build a model of the technology world where Apple is the focus of all competitive efforts. But this starts to sound absurd.

Indeed, the flaw in the logic is that these competitive pairings are based on the overlap of features of products/services being offered. The features become the attributes of a product which supposedly defines their competitive power. But this is false for the same reason that the attributes of a buyer do not determine their buying behavior. Buyer attributes1 are easy to measure and they may correlate to purchasing behavior but they don’t cause it.

Similarly, product or company attributes are easy to measure and they may correlate to competitive behavior but they don’t cause the substitution of a purchase.

Therefore, appealing to Apple to change its strategy, operations or even its core beliefs in response to a competitor’s behavior is deeply misguided. The cause of success and failure in the marketplace is based on being hired by the customer to get a job done. Once hired, the chances are that the trust is secured and the relationship continues even if alternatives are available. There is comfort in the knowledge of whom you’re working with.

This aspect of trusted relationship between the buyer and the product and the interweaving of ‘brand’ (aka intentions) of the hired is the root of loyalty. Of course, loyalties can be betrayed and trust can be lost. But that implies that the primary responsibility of the manager is the creation and preservation of trust. When seen in this light, an alternative axiom becomes clear:

“Great companies don’t have any competition.”

Great companies are “monopolists of customer trust” and are unaffected by alternatives. They are positioned on and nailing the job their products and services are hired for. The alternatives must not only duplicate the exact job (which they almost never do), but they must also overcome the switching costs.

Remember this when analyzing the impact of yet another competitor and considering the “Apple must fix/do X or else” assertions.

- E.g. demographic, sociographic [↩]

The 2015 “Sleeper Ideas” List: Trends, Stocks, And Private Companies To Watch – Forbes

My choices:

1. Cyanogen. This company should develop a credible path for AOSP (non-Google Android) especially in India. I expect a lot of traction as OEMs who embrace Android reject Google.

2. iPad. Not as a consumer product but for the Enterprise. The iPad grows up into a solid product for business while being replaced by phones in consumer “jobs to be done”.

A few more ideas are listed here: The 2015 “Sleeper Ideas” List: Trends, Stocks, And Private Companies To Watch – Forbes.

Biggest news of 2014

As corporate romances go, IBM and Apple’s must rank among the most unexpected. As I wrote on the date they changed their Facebook status, the two companies were antagonists for the better part of twenty years and their rapprochement was met with a shrug mostly because yet more decades passed since.

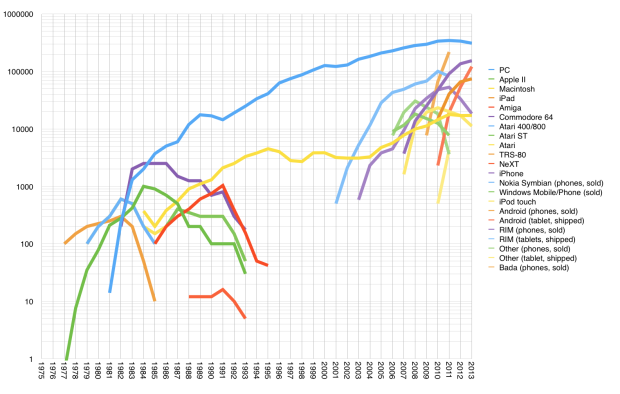

Nostalgia aside, this new union is profoundly important. It indicates and evidences change on a vast scale. The companies’ antagonism was due to being once aimed at the same business: computing. Since the early 1980s, “computing” came to be modularized into hundreds, perhaps thousands of business models. It is no longer as simple as selling beige boxes. IBM was forced out of building computers and into services and consulting while Apple moved to make devices and the software and services which make its hardware valuable.

The convergence of interests which was consummated into a deal this year stems from the migration of computing around what has come to be called “mobile”. Apple intends to accelerate the adoption of its mobile platforms among the remaining non-adopters: enterprises–a group which, by now, qualifies as laggards.1 Simultaneously IBM intends to connect data warehouses at those same enterprises to their employed users.

Continue reading “Biggest news of 2014”

- There was a time–when Apple was young–when enterprises were the innovators, early adopters. That role ended approximately in the year 2000 [↩]

Asymcar 20: Iconic Design

I recall details of a recent Tesla Model S test drive while evaluating their innovation on jobs to be done, form factor, design, production methods and their business model.

(Also, other goings on with Uber, BMW and Porsche).

The Critical Path #135: Fruit Fly Analysis

Horace outlines his work at The Clayton Christensen Institute and sets out a number of topics for upcoming shows. We also revisit YouTube and the art of self promotion.