The problem with getting better is that if you’re more than good enough you’re actually getting worse. Improving beyond the point where your improvements can be absorbed is not only wasteful but it’s also dangerous. It opens the door to competitors who compete asymmetrically.

This is the perverse and pervasive threat hanging over all system vendors. The temptation to “get better” is not coming from incentives and human nature. It’s always there as Moore’s Law offers an exponential increase in power. People don’t naturally have exponentially increasing needs. For them to absorb this new power, it has to be couched in new uses.

What has permitted the absorption of improvements in semiconductor performance (and production) have been other aspects of the system: the software, communications and services innovations have been positioned on more demanding jobs to be done which, once hired for those jobs, saturate the available processing and storage.

This is most easily evident in how digital photography has advanced. The constraints on sensors meant that quality was initially poor and as cameras were unconnected, they were relatively under-utilized. But once software and communications were added (by inclusion in smartphones) digital photo creation exploded. This, in turn, led to more storage needs both on the device and the servers. In a virtuous cycle, more processing power meant video was possible, then high definition video, then slow motion high definition video. The previous storage limits on mobile devices were quickly overwhelmed. Megabytes of storage became gigabytes and then hundreds of gigabytes. Video editing meant processing power was suddenly in demand again. Cores multiplied.

Third party media (music and videos) storage and playback used to be the main job that storage was hired to do1 but as cameras got better, user-generated content suddenly bellied up to the bar.

That is now the story for phones, which are gobbling up all the storage and bandwidth we can throw at them. But what about the larger form factors? Are iPads (and laptops) growing in their demands? Paradoxically, it would seem that the smaller devices are hungrier than their larger cousins.

The answer lies with the jobs to be done. If highly portable devices are more usable, they will be used more. Large devices are left behind, literally, because their jobs are not as pervasive in place and time. For a large screen like the iPad to increase its attractiveness, it has to be the stage for a set of jobs that only it can perform.

The new iPad has the horsepower. It has more portability (thinner, lighter) and it has the touch ID convenience. It even has a better camera. But for it to succeed it needs to be hired for a set of jobs as expansive in usage as the user-generated photo/video jobs that the iPhone has been called to do.

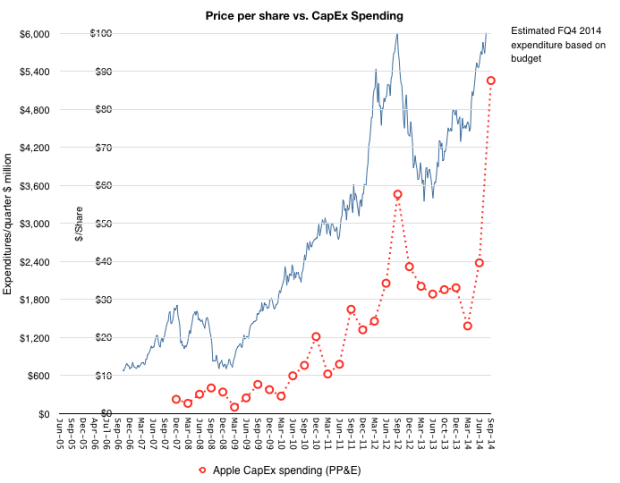

I hire my iPad for one such job: to persuade audiences small and large. I use it across a dining table and across an auditorium to appeal with a visual language. I use Perspective to create stories that have to be seen to be believed and once seen, create belief.

The tool is demanding however. As the stories are fed by data and the visualizations are rendered algorithmically and not as stored images it is hungry for processing power. I also need it to record performances which taxes storage. I need to transmit those performances both in real-time and as recordings, tasking the WiFi and cellular bandwidth. I need as much screen as I can get to be able to interact with the elements on screen, of which there may be hundreds. I need to export video versions of performances and thus I need a video studio with all its extravagance. I need it to run for all-day workshops connected to a projector, sometimes through AirPlay, under stage lights, which pushes the battery.

Consider my last padcast. It was recorded in one take lasting 18 minutes. I then exported the results to a video that was uploaded to Vimeo and viewed by thousands. However it took over one hour to render it and due to that constraint I did not have the luxury of editing it. I could not easily add, subtract or annotate the video production. This was done on an iPad Air and I was happy to get it done at all.

But if I had an iPad Air 2, not only would production time be shrunk2 the things I could attempt to do with a presentation suddenly expand. It’s not just about more efficiency but an expansion of scope. More power means more work I choose to do.

So is the new iPad better? As far as the jobs I hire it do do, the new iPad is better. It is in fact not good enough. Which is the best thing to be.