As Philip Elmer-DeWitt is still interested in my estimates I provided the following:

Revenues ($B) 57.8

EPS ($) 14 (908m shares)

iPhone (units) 56.4 million

iPod (units) 7.6 million

Mac (units) 4.14 million

iPad (units) 26.5 million

iTunes/Software/Services ($) 4.2B

Accessories ($) 2.2B

GM% (percentage) 37.1%

I arrived at these estimates without looking at anyone else’s (except for Apple’s own published guidance). Soon after sending them I noticed that Daniel Tello published his own.

In the same format as above, I quote them for comparison. Please visit his post for additional detail.

Revenues ($B) 59.0

EPS ($) 14.92 (895m shares)

iPhone (units) 56 million

iPod (units) 9 million

Mac (units) 4.65 million

iPad (units) 25.5 million

iTunes/Software/Services ($) 4.3B

Accessories ($) 1.8B

GM% (percentage) 37.8%

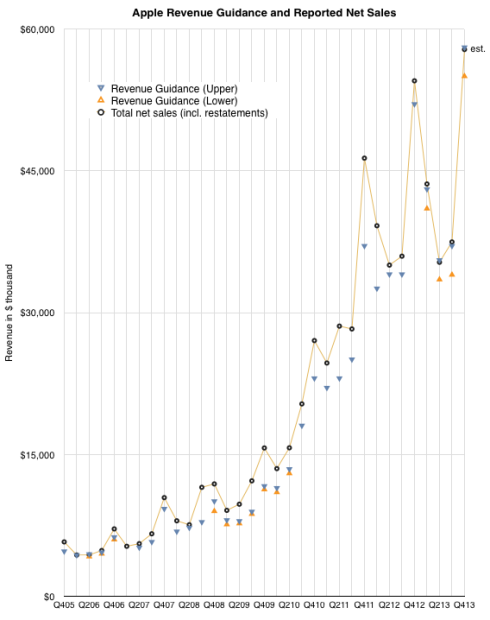

The graph below shows the history of revenue guidance vs. revenue reported. The last quarter shows my estimate for net sales.

Note that the company achieved at or slightly above its upper guidance ever since they started offering a range for guidance (i.e. since Q1 2013). My estimate for sales is therefore very near the top of guidance. The figures for units earnings and margins all result from this assumption.