The fascination with highly visible but largely unknown business models continues. How do infomercials work? What is the value of fashion? How can you make money when no creative idea can be protected? Why is Apple building a sapphire manufacturing facility? It’s all part of a pattern.

Asymcar 7: The Transportationist

The Transportationist, David Levinson @trnsprttnst joins us to discuss the technical, human, environmental and economic factors driving change to the auto-ecosystem.David helps us smartly survey the landscape via:

- Human behavior

- Technology lifecycles

- Urban transportion evolution

- Network capitalization

- Congestion

A yardstick for capex

Photo credit: Wikipedia, CVN-78

I’ve been writing about Apple’s capital intensive operations for some time. The difficulty has always been in explaining the scale involved. I’ve compared the spending to that of Samsung, Microsoft, Google, Intel and Amazon. But these numbers still can’t be easily grasped. You can’t point to any comparable objects when you try to explain the figure. I struggle to create a less abstract notion than that of a “sea of tooling and servers.”

Instead, I’ve used the analogy of US aircraft carriers. Historically, Nimitz class aircraft carriers have cost a less than $5 billion. The USS Ronald Reagan, christened in 2001, cost $4.5 billion. Therefore I was comfortable saying that Apple spends the equivalent of about one Nimitz class aircraft carrier every six months (and that the Navy takes about six years to put it together.)

Unfortunately, costs for aircraft carriers have gone up. The USS Gerald Ford will take about $13 billion to complete. That places Apple and Samsung capital spending in the following context: Continue reading “A yardstick for capex”

What’s an Active User worth?

Apple has sold 700 million iOS devices. Google claims one billion Android device activations. Microsoft has about 1.5 billion Windows users and Facebook about 1.19 billion. LinkedIn has 259 million users and Twitter has 232 million. Amazon has 215 active account holders and PayPal 137 million.

Markets place a value on these users implicitly when company shares are priced. For example, Twitter whose users are worth about $110 or FaceBook’s $98 and LinkedIn at $93.

This consistency suggests a universally accepted value per social media user but what is the value of an ecosystem user? Apple, Google, Microsoft and even Amazon aspire to enable ecosystems which should be seen are more valuable than mere communities. Ecosystems enable a higher level of economic activity because they are unbounded by the medium itself. Any number of media can be created. Or so the theory goes.

If we could determine a value for an ecosystem user we could test it against the going value of a social media user. Fortunately we have enough data to do so.

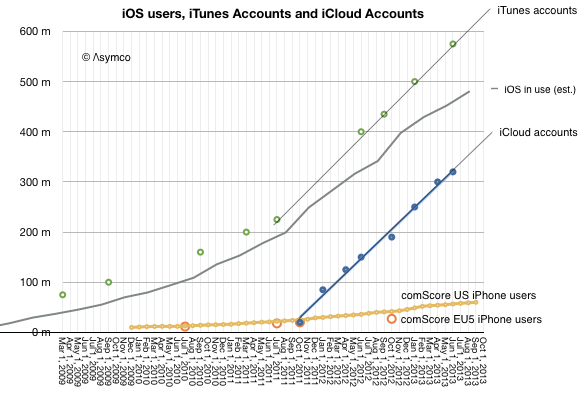

The total number of iOS devices sold per quarter allows us to measure the install base of device users. With some assumptions regarding the retirement and attrition rate we can get the following history:

Since the total number of iTunes accounts is updated with some regularity I’ve added it to the graph. I’ve also shown on the same graph the total number of iCloud accounts. For calibration, I included survey data showing the number of iPhone users in two regions (US and EU5). Continue reading “What’s an Active User worth?”

The Critical Path #100: Fin de siècle

The closing of one and the onset of another era. In this hundredth episode of The Critical Path we look back to some of the big questions we asked and ask them again with hindsight and foresight. They are:

- What happens to entertainment in the era of pervasive connectivity and computing?

- What happens to privacy when citizenship requires divulging all your secrets to commercial entities?

- What happens to the structure of computing when diffusions of innovations are instantly global?

How many years does Apple have?

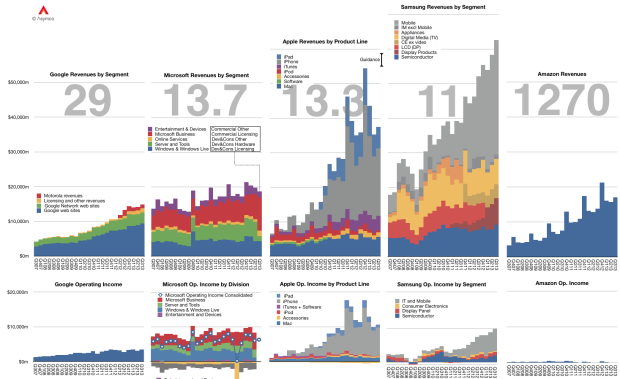

The graph below shows the Revenue and Operating Income for a select group of companies. The large numbers represent the share price to earnings (trailing twelve months) ratio (P/E or PE ratio).

Of course the P/E ratio hides a lot of subtlety. It mostly fails to account for the fact that earnings are largely a matter of opinion. A company can defer income (as Apple and Microsoft do), it can invest earnings (as Amazon does) and can otherwise avoid declaring it since it’s taxable. Continue reading “How many years does Apple have?”

The diffusion of iPhones as a learning process

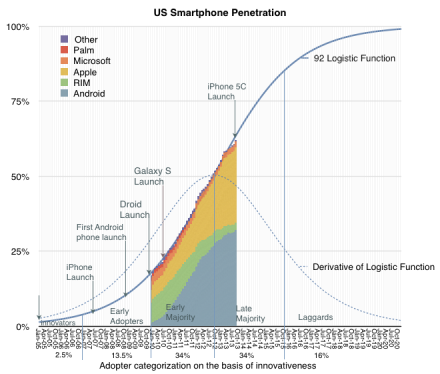

All theoretical and empirical diffusion studies agree that an innovation diffuses along a S-shaped trajectory. Indeed, the S-shaped pattern of diffusion appears to be a basic anthropologic phenomenon.

This observation dates as far back as 1895 when the French sociologist Gabriel Tarde first described the process of social change by an imitative “group-think” mechanism and a S-shaped pattern.1 In 1983 Everett Rogers, developed a more complete four stage model of the innovation decision process consisting of: (1) knowledge, (2) persuasion, (3) decision and implementation, and (4) confirmation.

Consequently, Rogers divided the population of potential adopters according to their adoption date and categorized them in terms of their standard deviation from the mean adoption date. He presented extensive empirical evidence to suggest a symmetric bell shaped curve for the distribution of adopters over time. This curve matches in shape the first derivative of the logistic growth and substitution curve as shown below.

In the graph above I applied the Rogers adopter characterization to the data we have on the adoption of smartphones in the US. The latest data covering September is included.

Continue reading “The diffusion of iPhones as a learning process”

- Tarde was probably influenced by mathematician Pierre François Verhulst who first published the logistic function in 1845 [↩]

Do ads work? The ad budgets of various companies

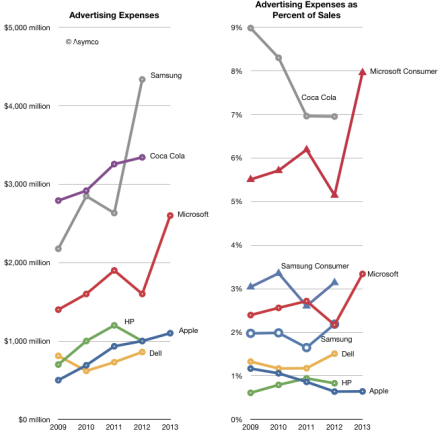

Microsoft spent $2.6 billion for Advertising in the fiscal year ended June. Apple spent $1.1 billion in its fiscal year ended October.

Other companies will report their full year ad spending later but their previous years’ spending is shown below.

I added a second graph showing the percent of sales that each ad budget represents. Note that Coca Cola retains the crown as the most prolific advertiser when it comes to budgeting.1

Continue reading “Do ads work? The ad budgets of various companies”

- Think of it as 7 percent of every Coke purchase going to pay for the ad that presumably got you to buy it. [↩]

Owing how much to how few?

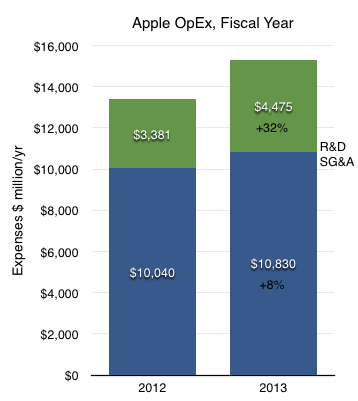

For the year ending October Apple’s R&D costs were $4.475 billion. These costs have been rising. Though, as the company explains, not faster than net sales:

The growth in R&D expense was driven by an increase in headcount and related expenses to support expanded R&D activities. Although total R&D expense increased 32% and 39% in 2013 and 2012, respectively, it remained fairly consistent as a percentage of net sales.

[My emphasis]

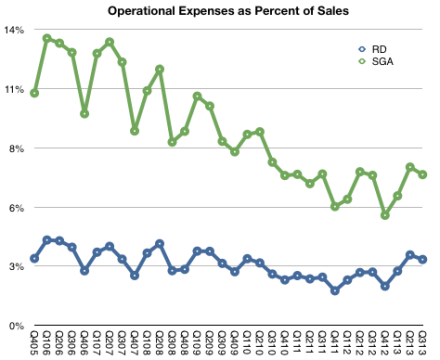

We can see this in the following graph:

R&D has remained very nearly 3% of sales since at least 2005.

SG&A Expenses barely grew however:

The growth in SG&A during 2013 was primarily due to the Company’s continued expansion of its Retail segment and increased headcount and related expenses, partially offset by decreased spending on professional services.

The change in R&D and SG&A on a full-year basis is shown below.

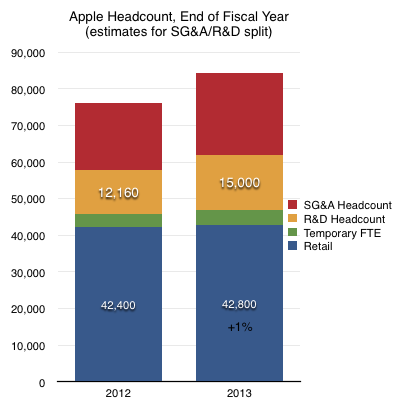

I emphasized the mention of increases in headcount. We cannot know with any precision what portion of last year’s $15 billion in operating expenses went toward wage expenses since there are other costs such as advertising1 commissions and public relations in the case of SG&A and outside services, equipment leases, in the case of R&D. However, it’s more likely that wage expenses are a far larger proportion of total R&D than they are of SG&A.

My estimate, based on wage rates, is that there are approximately 15,000 R&D staff at Apple.

If we divide sales by this number we get $11.4 million in sales per engineer.

- Apple’s advertising expenditures for fiscal 2013 were $1.1 billion or 10% of SG&A or 0.64% of sales. [↩]

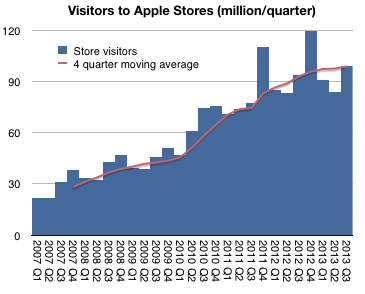

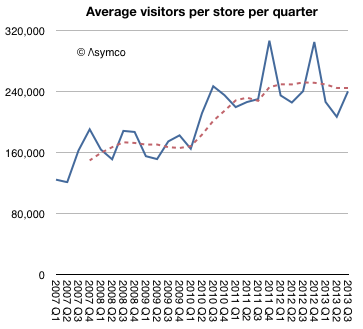

The Quantum Leap in Retail

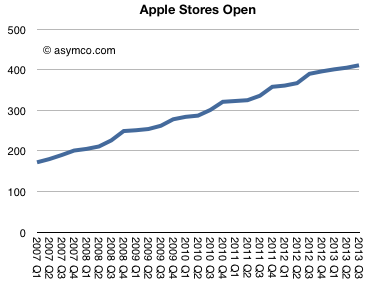

In fiscal 2013 there were 395 million visits to Apple retail stores. In 2012 there were 372 million.

The difference is approximately the population of Australia. This was in addition to the population of the US and Canada already passing through. Although this is a fun way to think about total traffic, it does not reflect performance of the stores themselves since new stores are always being opened. 21 new stores in 2013, to be precise.

The better benchmark should be the number of visitors per store.

This shows that, except for seasonal peaks, the visitors per store per quarter has been a fairly steady 240k since mid-2010. What’s more, this rate was also remarkably steady at around 160k/store/quarter from 2007 to 2010.

So what caused this quantum jump1 in traffic? Continue reading “The Quantum Leap in Retail”

- “Quantum leap” is often used to mean “giant leap” but in the original usage it meant a specific, discrete jump [↩]