My thanks to Niaz Uddin for asking some good questions and posting my replies:

Horace Dediu on Asymco, Apple and Future of Computing | eTalks.

Full interview is here, excerpts below:

Niaz: Why do you study Apple?

Horace: Apple is an interesting company to study because its success comes from being a serial disruptor. This is a very rare type of success formula. I am trying to “reverse engineer” its operating model and I hope that such a model is one which others might learn from if they were to emulate it. The trouble is that very few others seem to want to emulate Apple. Why that is is also an interesting question.

Niaz: […] Do you think apple has lost its image that it has created over the years as a center of innovation and building excellent products?

Horace: I cannot comment on how Apple’s image is measured by people in the industry. I have been listening to commentary on Apple for about a decade and I have never seen any change in pattern. The company has always been perceived as a failure by a majority of observers. With respect to its products, I also do not see a change in the pattern established over the last decade.

Niaz: Are you optimist about the future success of Apple? Like after 10 years and then 20 years?

Horace: Let me put it this way: if there were no Apple then somebody will have to invent an Apple to do the same thing Apple does. In that sense I’m optimistic that there will be an Apple in some way in perpetuity.

Niaz: What will be the next big innovation from Apple?

Horace: I have no idea but it’s likely to involve refining new user interaction methods. Similar to the breakthroughs that came from the use of a mouse, a scroll wheel and a touch screen. It means making computers better at gleaning our intentions without our getting involved in explaining them.

Niaz: Will Apple, Google and Samsung be the major player for the future of computing? Or we can hope to see some new faces?

Horace: I am fairly sure Samsung will not be because they have not yet grafted software and services to their operating structure. I would give Amazon a higher probability in being a successful platform alternative.

Niaz: In 2011 you’ve written a blog post ‘Steve Jobs’ Ultimate Lesson for Companies’ on Harvard Business Review Blog and you have cited ‘A leader should aspire to do more. A leader should claim to have left a legacy not just on their company but on all companies.’ As you know Google, Amazon, Samsung, Facebook … all have learnt lifetime lessons from Steve Jobs. What do you think about the impact that Steve Jobs have created?

Horace: He led by example and like all great leaders sacrificed much as a way to inspire others to follow him. He also spent time in the wilderness and chose asceticism. This gave him authority. Many historical figures had the same quality. The problem is that few business leaders have it but I don’t see why they shouldn’t.

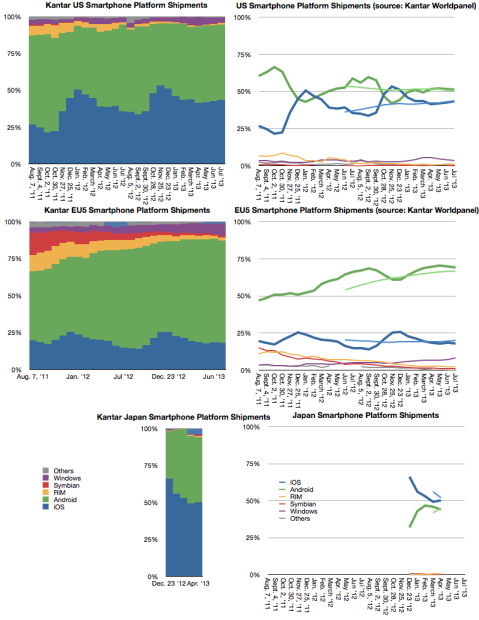

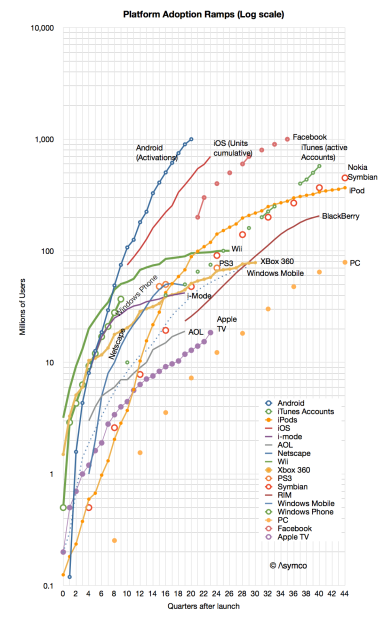

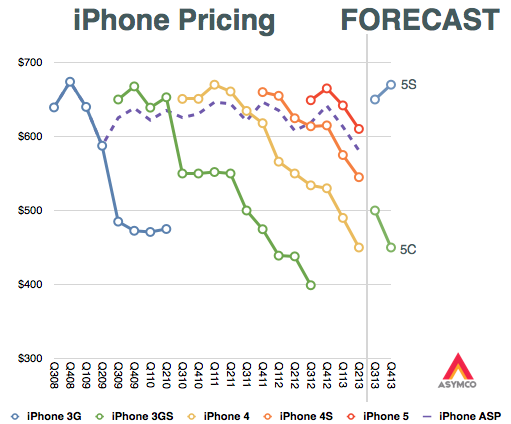

Much more on evaluating Tim Cook’s performance, the iPhone portfolio, the rise of Android, Microsoft/Nokia, wearable technology and disrupting Google. Check it out on eTalks.