Youtubers, BlackBerries and what Facebook is planning with their “Home on Android”. Horace and Moisés discuss how co-branding, strategy, and secret deals intertwine, with illustrations from Intel, Sony-Ericsson, and Acura

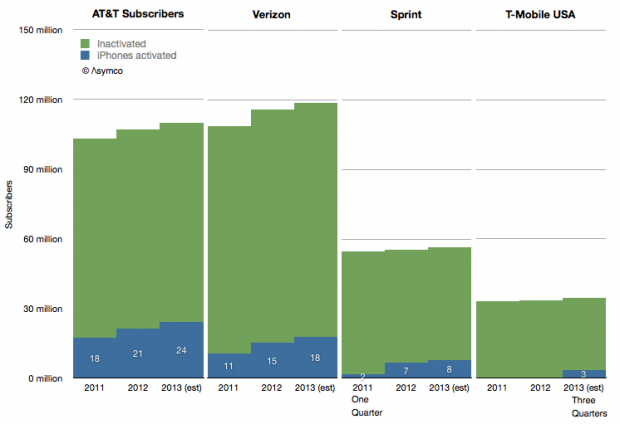

How many iPhones will T-Mobile USA sell?

From the initial product launch until the end of 2012, AT&T has activated 72 million iPhones. Verizon began selling iPhones four years after AT&T and managed to activate 26 million since. Sprint began nine months after Verizon and has activated 8.5 million.

In proportion of their subscriber bases, the activations are shown in the following graph.

I identified the reported iPhone activations with blue areas while the sum of green and blue areas represent total subs at the end a the given year.

I also took the liberty of forecasting 2013 data in order to try to estimate T-Mobile’s contribution.

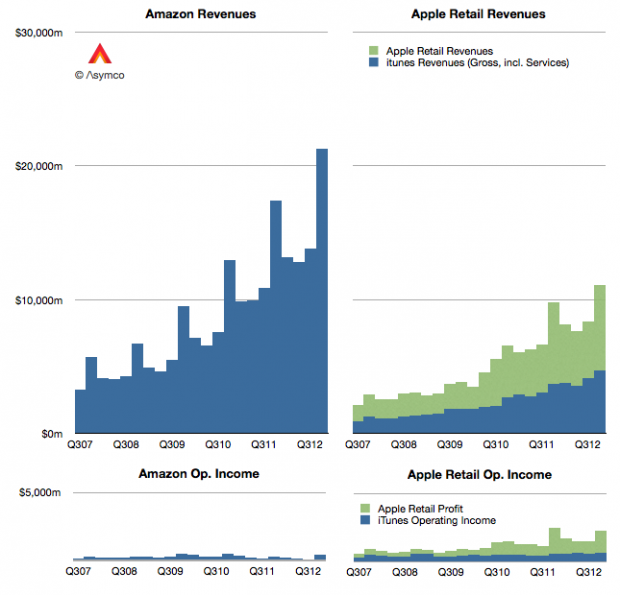

Apple retail vs. Amazon retail

As part of a continuing series on the iTunes economy I described how iTunes fits within Apple’s overall revenue and cost structure. The operation is a modest contributor accounting for single-digits percent of revenue and operating margins.

One additional question is how does iTunes compare with other non-Apple retail businesses. The obvious comparable businesses are Google Play and Amazon’s digital content businesses. Unfortunately we can’t compare iTunes with Google Play because Google does not reveal any details about Play revenues (or units sold/downloaded or payments to developers or any other data.)

Also unfortunately, we can’t compare iTunes with Amazon digital sales because Amazon does not provide that detail either.

What we do have is Amazon’s overall revenues (and operating margin.) So that’s what I have compared:

Since we have Amazon’s overall retail revenues it seemed fitting to also add Apple’s physical store retail data on top of iTunes for additional perspective.

Here are some observations: Continue reading “Apple retail vs. Amazon retail”

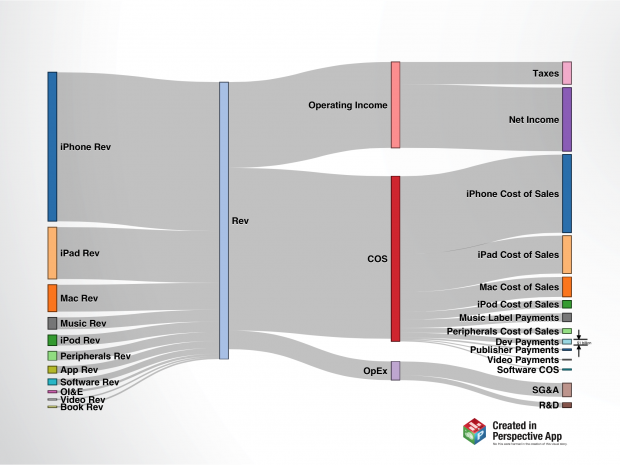

iTunes Segment Revenues in Context

In the last few posts I estimated the iTunes economy in some detail. In absolute figures, the revenues and cost structures of iTunes are substantial:

- 6.3 billion transactions in the last quarter

- $4.6 billion consolidated revenues (including software & services)

- $3.3 billion in content payments

- $650 million in operating income

However, as a part of the entire Apple revenue model, iTunes appears to be a small contributor. The following diagrams shows where revenues came from and where they were spent during the last quarter

A few notes: Continue reading “iTunes Segment Revenues in Context”

The Critical Path #77: Making Sausages

The more we deconstruct and take apart iTunes, the more we come to respect how is cannot exist independent of the system it’s a part of. Its scope and scale and its history and future all indicate that there is more to it than just a store and that it might be a platform in its own right. We get into some more details about all these details and talk about where it came from and where we think it will end up.

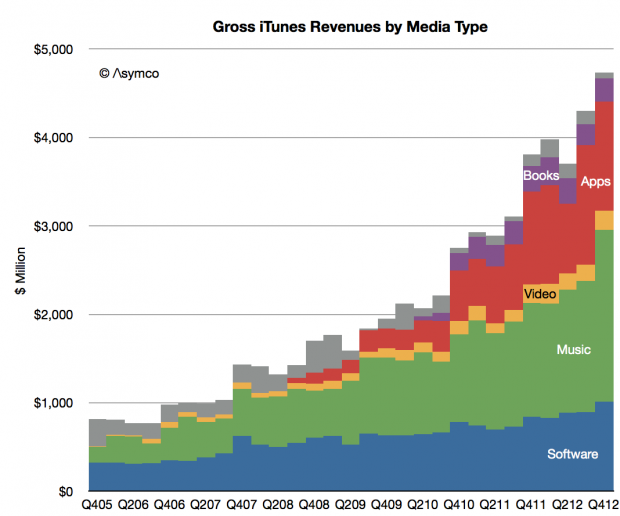

So long, break-even

The following is another excerpt from a report titled “iTunes Business Review” which will soon be available for purchase through the Asymco Store. If you are interested in the product please get in touch.

—

iTunes store will be 10 years old next month. From its inception Apple has stated that it aims to run the store “at break-even”. The business has grown so rapidly however that its profit-free nature has come under severe pressure.

The reasoning goes that as more media types have been added costs have increased but revenues have increased even faster. Consider the estimated gross revenue base as shown below:

What is known as iTunes today has quintupled in seven years. Although cost of content sales are likely to have been preserved as a ratio (about 30%) the vastness of transaction volume (estimated at 23 billion item transactions in 2012 alone) implies that there are some significant economies of scale.

This implies that the operating costs are spread more evenly and that therefore the possibility exists for some operating margin. Continue reading “So long, break-even”

The Conundrum of iTunes' Recognition of Revenues

An excerpt from a report titled “iTunes Business Review” which I’m currently writing:

Revenue Recognition

Before proceeding it’s also important to understand one more detail: The company does not report all transactions through iTunes as revenue. To quote the 2012 Annual Report (10 K):

For third-party applications sold through the App Store and Mac App Store and certain digital content sold through the iTunes Store, the Company does not determine the selling price of the products and is not the primary obligor to the customer. Therefore, the Company accounts for such sales on a net basis by recognizing in net sales only the commission it retains from each sale. The portion of the gross amount billed to customers that is remitted by the Company to third-party app developers and certain digital content owners is not reflected in the Company’s Consolidated Statements of Operations.

What this means is that App revenues are only reported at the 30% level that is retained by Apple. The 70% paid to developers is excluded from Apple’s financial reports. The same is true for other products for which it considers to be acting as an agent. The difference seems to be mostly in cases where Apple does not define the end user pricing. This is mostly true for ebooks however that may not be true for all book titles.

This distinction between “gross” revenues and “reported” revenues is maintained in this report but both are presented for consideration. Gross revenues are needed for comparing the media businesses against each other and for competitive assessment but reported revenues are needed to test assumptions against ground truth.

This can be explained with an example:

If a song sells for 99c then Apple reports all 99c as Revenue and then pays the record company about 70c and uses 30c to operate the store and pay for transaction costs. In the case of music it means the Gross Revenue is 99c and the Reported Revenue is also 99c.

However, if an app sells for 99c then Apple reports only about 30c as Revenue. It does not consider the portion paid to developers as revenues for itself. It spends a portion of the 30c to pay for transactions, hosting, and the time testing and accepting the apps. In the case of apps and books it means the Gross Revenue is 99c and the Reported Revenue is 30c.

So if Apple sells one song and one app then the Consolidated Gross Revenue is 2 x 99c or $1.98 but the Consolidated Reported Revenue is only $1.29 (99c + 30c).

The difference in accounting is sometimes called “agency” vs. “wholesale” and it applies in some retail businesses. Another term sometimes used for used goods is selling items “on consignment“.

The reasoning for why some media are treated one way or another is cited in the Annual report as “the Company does not determine the selling price of the products and is not the primary obligor to the customer”. In the case of Apps, the price is set by the developer and the developer is obligated to deliver on the promise. Apple acts as transaction processor and they don’t consider that they ever owned (and hence never sold) the app. Note that this accounting is probably discretionary. They decided to do it this way and it’s not clear that it was necessary to do it this way by any regulation.

This distinction between two treatments of revenue makes it difficult to understand the complete story behind iTunes.

—

If you’re interested in the full report, contact me directly.

UPDATE:

Apple’s rationale can be partly justified from a reading of a Financial Accounting Standards Board statement titled “Reporting Revenue Gross as a Principal versus Net as an Agent” (Emerging Issues Task Force Abstract EITF 99-19 http://www.fasb.org/pdf/abs99-19.pdf) a portion of which is quoted below.

“Indicators of Net Revenue Reporting

15. The supplier (not the company) is the primary obligor in the arrangement— Whether a supplier or a company is responsible for providing the product or service desired by a customer is a strong indicator of the company’s role in the transaction. If a supplier (and not the company) is responsible for fulfillment, including the acceptability of the product(s) or service(s) ordered or purchased by a customer, that fact may indicate that the company does not have risks and rewards as principal in the transaction and that it should record revenue net based on the amount retained (that is, the amount billed to the customer less the amount paid to a supplier). Representations (written or otherwise) made by a company during marketing and the terms of the sales contract generally will provide evidence as to a customer’s understanding of whether the company or the supplier is responsible for fulfilling the ordered product or service.

5by5 | The Critical Path #76: Google vs. Android

Beginning with the data on activations, we traverse the strategic implications of a shift in Android governance and management. Along the way we also cover Samsung’s marketing strategy, budget, and the Galaxy S 4 launch.

New Padcast: The Ecosystem Wars and the Factory

2013 will see two billion phones shipped to over 4 billion consumers. Contrary to the common assumption that larger markets sustain more competitors, this rapidly growing market is profitable for only two device vendors. Horace Dediu seeks answers to this paradox at the Harvard Business School Technology and Operations Management Digital Seminar Series. Self-recorded live on March 7, 2013, 45mins, 22.5Mb.

Download for iPad and iPhone: here. Requires Perspective app from Pixxa.

Interview with Anouch Seydtaghia of Le Temps regarding the Galaxy S4

This interview took place on the eve of the launch of the Galaxy S4. Anouch Seydtaghia is Deputy Head of the Economic & Finance Section chez Le Temps Geneva, Switzerland.

—

Q: How can you explain that Samsung organizes such a huge event in NY for the S4?

A: The S4 is a very important product as it’s probably the second most profitable mobile phone in the world. Samsung is trying to position it as a premium product and is using every means available to do so.

What are your thoughts about the huge marketing budget of Samsung?

Samsung’s marketing budget has been a constant percent of their sales (approximately). As sales have risen, the budget has risen. This is not considered a normal situation if sales grow very rapidly but Samsung seems to consider x% of sales to be appropriate spending level. Note that Apple’s marketing has fallen as a percent of sales while its sales have grown dramatically.

If we read the media, we see a lot of speculation about the features of the future S4. Can we now compare that to the expectations before a new iPhone?

There are speculations about all phones, from Nokia to HTC and BlackBerry. I don’t see the speculation to be different between all the major companies.

Can Apple regain the lead in the smartphone market? If yes, how?

Continue reading “Interview with Anouch Seydtaghia of Le Temps regarding the Galaxy S4”