This was fun.

You can see the original description and download links here.

In 2012 Apple opened 41 stores. The total is the second highest yearly opening rate since the stores first began operating. The highest total was in 2008 when 47 stores opened.

Although it is a healthy total, the surprising story about retail is that stores are not being opened as quickly as Apple’s sales and reach are growing. The following graph shows the yearly opening rate.

The line in the graph above shows the change net sales since 2006 (right scale).

The store opening rate has been around 40/yr. during the last five years, up from 30/yr. during first seven but a 33% growth rate it’s still a frustratingly slow rate of growth. Consider that during 2007 when Apple opened 34 stores, Apple’s net sales were growing at the rate of $7 billion/yr and that in 2012 when it opened 41 stores sales grew about $37 billion or more than 5 times faster.

Although performance for the stores has improved (i.e. the sales per store went up), sales outside of their own retail channel are now a far higher portion of total. 2007 retail revenues were $4.7 billion or 17% while 2012 were $19.1 billion or 12%. You can see the mix by region in the following graph: Continue reading “Apple's International Retail Strategy”

Google announced its first computing product: the Pixel. It’s not the first Chromebook but it is the first device which is uniquely branded as a Google product (Motorola notwithstanding.)

It’s a curious choice given that companies which have “crossed-over” from being service or software oriented to hardware have started with more “mobile” devices. Amazon launched the Kindle as a low-end product and gradually moved it up-market. Microsoft launched with the Surface tablet and then followed with the Pro version as a hybrid laptop/tablet.

It’s also curious since Google has spent years contributing to the development of mobile phones and tablets under the Nexus sub-brand. This was an approach consistent with earlier Chromebooks as well.

But the Pixel is a high-end product. It’s priced at the top of the range of what a laptop computer might cost (given the dimensions). Perhaps it’s part of a pattern where Google will hone its hardware skills toward releasing a phone or tablet it can call its own. Starting with a more traditional computer is “easier” than trying to deliver on the more demanding smaller form factors.

And yet, the more obvious question is why would Google want to be in the hardware business? Isn’t being a web-focused company implicitly suggesting that hardware is a commodity to be farmed off to perpetually impoverished and violently abused OEMs?

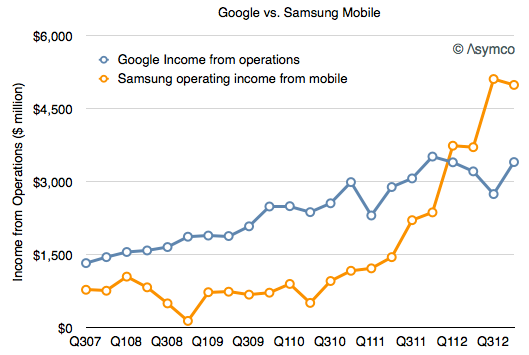

The truth is quite different from this. Samsung currently makes far more operating profit from Android phones than Google does from all its operations.

When looking at the patterns of sales and profit capture for hardware vendors since 2007 the contrast is stark: Continue reading “Bits v. Bytes: Follow the money”

I’ll be speaking at the Harvard Business School Technology and Operations Management Digital Seminar Series on “The evolution of value chains in a computing markets measured in the billions of units per year.”

2013 will see two billion phones shipped into a market of over 6 billion points of network connectivity for over 4 billion consumers. In addition to phones, there will be a few hundred million more tablets and mobile computers shipped. It’s very likely that the majority of these devices will be “smart”, meaning designed to be a part of an ecosystem of software, content and services. Contrary to the common assumption that larger markets sustain more competitors, this immense and rapidly growing market has become profitable for only two device vendors. The reason is that the windows for competitive advantage are fairly narrow and although production can be ramped more quickly than ever, the resources needed are available to few. The frequency and amplitude of market flux benefits only those who can operate at scale and punishes those who can’t. Close observation of the investments of these “superpower” competitors shows an extraordinary level of capital purchases of manufacturing equipment, regardless of their nominal position in the value chain. These capital expenses have been growing in proportion to in the frequency of product launches. I present data showing a correlation between manufacturing equipment CapEx and ecosystem success and put forward a hypothesis that this relationship is causal. I also discuss the implications for ecosystems owners with regard to the processes, resources and priorities necessary to succeed in this evolved value chain.

The event is open to the public and taking place March 7th, 3:00PM to 4:30PM in the Cotting Conference Room.

Apple’s products are the envy of the world. They have been spectacularly successful and are widely imitated, if not copied. The expectation that precedes a new Apple product launch is only matched by the expectation of the replication of those products by competitors.

This cycle of product mimicry was succinctly summarized by Marc Andreessen regarding a rumored Apple TV product:

And once the television launches, everyone will scramble to copy it. “There’s a pattern in our industry, Apple crystallizes the product, and the minute Apple crystallizes it, then everyone knows how to compete.”

This idea that the basis of competition is set by Apple and then the race is on to climb the trajectory of improvement is so well understood that it’s axiomatic: “It’s just the way things are.” Apple releases a product that defines a category or disrupts an industry and it becomes obvious what needs to be built.

But what I wonder is why there isn’t a desire to copy Apple’s product creation process. Why isn’t the catalyst for a new category or disruption put forward by another company? More precisely, why isn’t there another company which consistently re-defines categories and repeatedly, predictably even, re-defines how technology is used.

Put another way: Why is it that everyone wants to copy Apple’s products but nobody wants to copy being Apple?

Note that I don’t suggest that there isn’t a capability to copy. It may or may not be possible, but capability comes after desire and without desire there can be no capability. What I’m suggesting is that there isn’t a desire to “be like Apple”. If there were a desire, we would be seeing a massive search and debate into what makes Apple successful. Management consultants would be pounding the pavement pitching the “Apple way”. Wall Street would be sizing up companies to a standard of “Apple-ness” and rewarding those who conform and punishing those who don’t.

None of this is happening. I can think of two reasons why:

A review of the Apple Store international roll-out process; a preview of an analysis of Apple’s innovation culture as described by Tim Cook; a reflection on the sustainability of growth: personal, institutional and societal.

via 5by5 | The Critical Path #73: The Best Single Invention of Life.

A short interview for iCon where I’ll be presenting tomorrow. The interview originally took place on January 9th, 2013.

Jasna Sykorova: You have focused on mobile devices for some time now. What made you to start to give a special attention to Apple related data?

I began to look at Apple in 2005; long before they were in the phone market. I had an iPod and liked the Mac but I did not have particular reason to think about the company. You might find it strange that it was the launch of two very peculiar products that caused me to change my perception of the company. They were the iPod Shuffle and the Mac mini.

These are not seen as important today nor were they back then. But they signaled to me that something dramatic was happening: the company was shedding its “premium” image. This and the earlier move of iTunes to Windows signaled [to me] that Apple was serious about the mass market and the minimum price that a person would need to pay to become an Apple owner.

This was pivotal to me also from the point of view of disruption theory. If a company takes the fight to the low end it means it protects itself from a low end disruptor and may even enter new markets. So if the thinking is that Apple would disrupt then it would have to get into new categories. I then asked myself what it would target. I told myself (again, in 2005) that Apple will do three things:

1 and 2 are well understood to have happened and 3 is nearly here with Apple TV.

Each of these were tremendous opportunities and it’s been fun watching it happen over the last 7 years.

By the way, my expectations were right not because of any insight into the company. I had not studied Apple much at the time. All my expectations came from understanding the psychology of a disruptor. Nor does it mean that what Apple did was deliberately planned. It’s possible to predict what people will do even if they don’t know what they will do themselves.

Can data tell stories? Can you judge just by data?

Yesterday Tim Cook spoke at the the 2013 Goldman Sachs conference:

There’s no better place to discover, explore and learn about our products than in retail. It’s the retail experience where you walk in and you instantly realize this store is not here for the purpose of selling. It’s here for the purpose of serving. I’m not even sure “store” is the right word anymore. They’ve taken on a role much broader than that. They are the face of Apple for almost all of our customers

Last quarter, we welcomed 120 million people in our stores.

We only have a little over 400 [stores]. Last year, we welcomed 370 million into the stores.

We’re closing 20 of our stores and moving them and making them larger this year. And in addition to that 20, we’re adding 30 more. Those 30 will be disproportionally outside the U.S. That gets us in 13 countries. Continue reading “Tim Cook's comments on Apple Stores, illustrated”

On February 6th, 2013 Apple reported that a total of 25 billion songs had been downloaded from its iTunes music store. The previous definitive value was in October 2011 though there was mention of “more than 20 billion” in November. App download totals have recently been much more frequently updated as the following chart shows:

[I estimated 21 billion for the November total.]

The latest two data points point to a surge in iTunes song download rates. Prior to last fall the download rate seemed to be hovering around 10 million songs per day. Continue reading “Right on Cue”

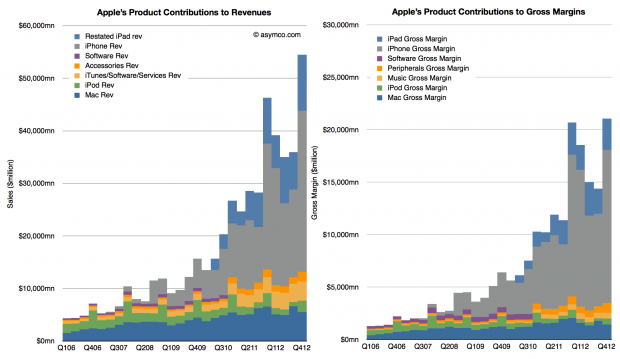

As Apple introduced a new set of revenue categories, the performance of its “minor” businesses has become clearer. The changes include re-statement of what used to be called “Software” revenues as part of iTunes. Apple Software includes sales of OS X, iWork and its pro tools. These products are now sold through the Mac App and since that is a part of iTunes its inclusion makes sense.

However, we have to understand that iTunes now is a blend of many business models. Some, like music, use a wholesale revenue recognition method and have very low to zero margins, others, like eBooks and Apps, are sold using an “agency” revenue model with potentially higher margins and some, like Software, are recognized at full value with very high margins.

When re-stated this way, iTunes becomes much more than a “break-even” business. My own estimate for its gross margin as currently reported is between 15% and 17% but it could be even higher. This allows the following picture to emerge:

These graphs show contributions to Revenue and Gross Margins of the various reported product categories. Note that restatements for Accessories and iTunes only extend back to Q4 2010 and the older “Software” is still shown for earlier periods.

These graphs show contributions to Revenue and Gross Margins of the various reported product categories. Note that restatements for Accessories and iTunes only extend back to Q4 2010 and the older “Software” is still shown for earlier periods.

Note also that Accessories are now including some of the revenue that used to be reported as part of iPad and iPhone revenues. This was discussed in more detail here.

There are several observations we can make: Continue reading “Counting stool legs”