Thanks to Angel Lamuno for sending me to a dry and boring lecture by Dr. Israel Kirzner from Feburary 1988. It got me thinking again about competition and how confusing it can be.

The lecture was in part about how the word “competition” is used by economists with directly opposing meaning from that of the layman and how that leads to confusion about the role of free markets.

I won’t dwell on that, but instead I want to explain how this word can also be contradictory in meaning when applied in everyday usage in business analysis. Nowhere is this more evident than when we argue whether Apple competes with X or Y or Z.

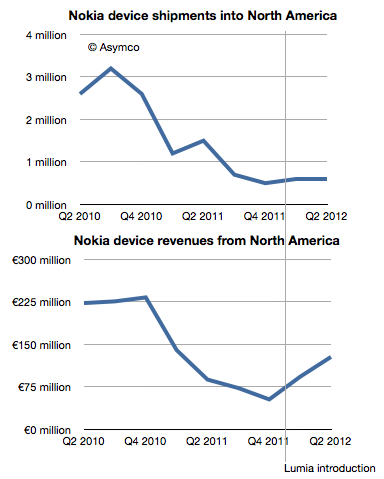

Does Apple compete with Android or Google or Samsung? How could Apple compete with Google and yet cause it to be the default search engine in Safari thus enriching their competitors? How could Apple compete with Samsung and yet select their semiconductors for the heart of its most important and profitable product? And how could the people across the table from Apple agree to terms on these deals while being sued by them?

Some have tried to characterize this situation as “coopetition” or the co-habitation of conflicting strategies for a balanced optimum. I find this characterization uncomfortable and unsatisfying. The balance sought will be very fragile and change daily and no optimization is practically possible. It seems contrived.

Rather, I think about these situations as examples of asymmetric competition. This is competition where companies are rivals but they have different definitions of the basis of competition. In a way, they are like gladiators who have weapons which cannot be brought to bear or wielded effectively to counter the opponent’s.

Consider the following question: does the iPhone compete with the Galaxy SIII? Continue reading “Asymmetric Competition”