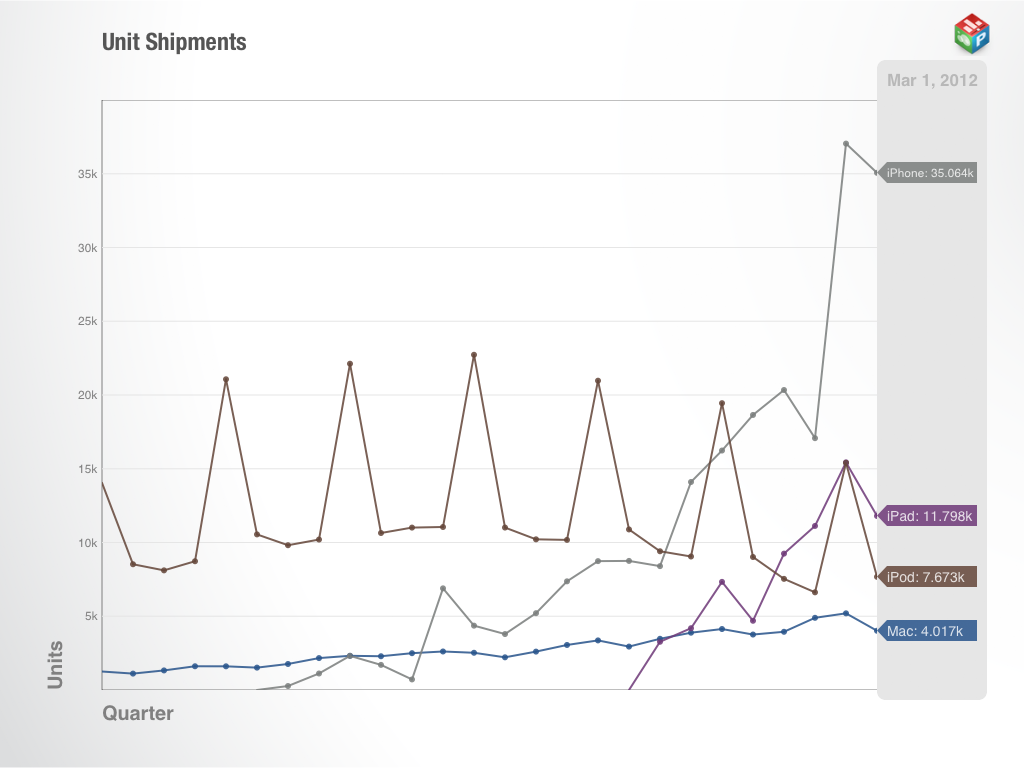

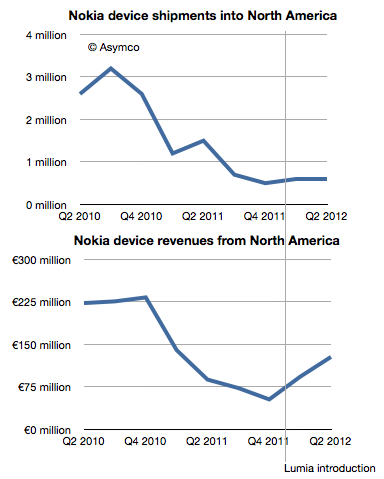

In my last podcast (Impatient for Growth) I mentioned my frustration at Apple’s slow entry into emerging markets outside of China. I cited Tim Cook’s comments that he did not see an opportunity there in the short term. He mentioned the multi-level distribution challenge which I took to mean the difficulty in setting up Apple stores (in itself due to restrictions on foreign owned retail chains) and the absence of device/service bundling.

This requires more analysis and the best place to start is to look at the data available.

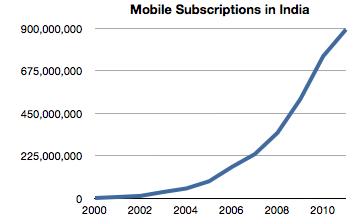

The market potential is enormous. Globally, there are 6 billion mobile cellular subscriptions (end of 2011, ITU) and 86% penetration, but only 1 billion have mobile broadband subscriptions (which make ownership of a smartphone worthwhile). In India there are 893 million subs (vs 986 million in China).

In 2011 142 million mobile cellular subscriptions were added in India, more than in the Arab States, CIS and Europe put together.

So the potential and growth are spectacular. But that is just 2G. Mobile broadband (i.e. 3G) is rare. Globally, developing countries have only 8% mobile broadband penetration vs. 51% in the developed world. Mobile broadband is a proxy for mass adoption of the iPhone (though perhaps not for Android inasmuch as it’s employed as a feature phone).

The situation for 3G in India is even worse than the overall developing world. Continue reading “Cracking the India Code”