Register here.

Android Economics

Charles Arthur, writing for The Guardian, has noted that court filings seem to be revealing Google’s Android revenues. If this is the case, we have a significant breakthrough in understanding the economics of Android and the overall mobile platform strategy of Google.

The new data is a reference to a settlement offer Google made to Oracle of $2.8 million and 0.515% of Android revenues on an ongoing basis. The key assumption to make this data useful is that the $2.8 million offer represents 0.515% of revenues to date.

In other words, that revenues from 2008 to end of 2011 multiplied by 0.00515 results in $2.8 million. That implies that revenues from 2008 to 2011 were $544 million.

I think that’s a fair assumption. I don’t see why Google would offer a higher or lower royalty rate for years 2008 through 2011 than for years after 2011. The offer would seem to be 0.0515% in the future as well as retroactively in the past.

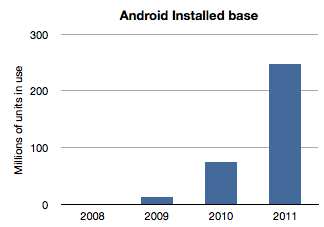

If we work with this assumption then the next question is how to distribute this $544 million over the four years 2008 through 2011? The installed base of Android has grown exponentially and it would seem logical to assume that revenues have followed in a similar pattern. Here is a chart of installed base given activation data supplied by Google.

If we assume revenues were distributed the same way we would get something like this: Continue reading “Android Economics”

RIM to give up

RIM’s CEO, Thorsten Heins was quoted as saying, “We plan to refocus on the enterprise business and capitalize on our leading position in this segment. We believe that BlackBerry cannot succeed if we tried to be everybody’s darling and all things to all people. Therefore, we plan to build on our strength.”

via RIM to give up most consumer markets | Ubergizmo.

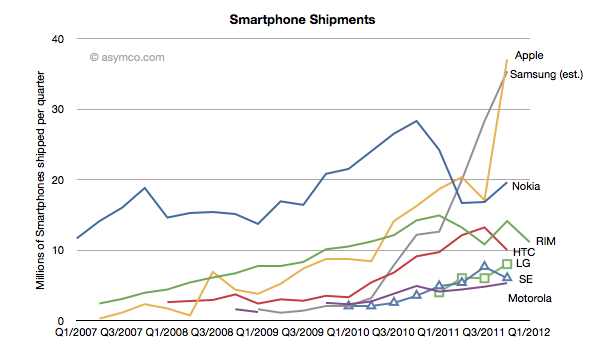

RIM’s latest quarterly results show a continuation of the decline in sales that began in Q1 2011.

Here are the highlights: Continue reading “RIM to give up”

Top-down vs. bottom-up: Which market analysis method is appropriate when disruption is knocking

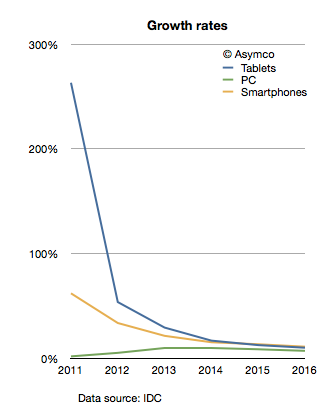

In terms of platforms, IDC expects a relatively dramatic shift between 2011 and 2016, with the once-dominant Windows on x86 platform, consisting of PCs running the Windows operating system on any x86-compatible CPU, slipping from a leading 35.9% share in 2011 down to 25.1% in 2016. The number of Android-based devices running on ARM CPUs, on the other hand, will grow modestly from 29.4% share in 2011 to a market-leading 31.1% share in 2016. Meanwhile, iOS-based devices will grow from 14.6% share in 2011 to 17.3% in 2016.

Via: IDC – Press Release – prUS23398412

The company provides a stacked bar chart (follow link above) to illustrate their view of the market. I took the data they included and measured the implied growth rates for the product categories:

IDC is implying that in four years the tablet market will be growing at 10%, the Smartphone market will grow at 11% and the PC category will grow at 11%. Continue reading “Top-down vs. bottom-up: Which market analysis method is appropriate when disruption is knocking”

5by5 | The Critical Path #31: Greenlighting

Horace talks to Mike Schneider, a feature film development executive about what development means in the context of filmmaking. We cover the changes the development process faces, the impact of technology on business models and the future role of development in a more integrated film value chain.

Apple at $600. Who knew?

Apple’s share price has increased rapidly in the last few weeks. The rise to $600 was swift and broke the pattern of slow growth the the stock was able to obtain over the past few years. The level, however, shouldn’t have been a complete surprise.

I think Apple is going to $600…It’s really not that complicated. Apple has a number of key drivers in its business model which have yet to be properly priced into the stock because I think it’s very cheap at this level.

-Stephen Coleman, chief investment officer at Daedalus Capital

This prediction was made October 26, 2007. On that date Apple’s share price closed at $184.7. It may have seemed like a bold bet, but as Coleman noted, the reason why it would reach $600 was easy to spot.

The real story on how I get to that valuation doesn’t even involve the sale of (the Leopard operating system) or the growth in the Mac business. How I get there is through the iPhone itself.

What was not easy to tell was when it would reach $600. Continue reading “Apple at $600. Who knew?”

The parable of Nintendo

With the launch of the Wii console, Nintendo averted disaster. When the Wii launched in late 2006 Nintendo had been facing the simultaneous attack from the “seventh generation” Xbox 360 which launched a year earlier as well as the PlayStation 3, both of which set as their bases of competition 3D graphics at HD resolutions. Many wrote off the company and called the console market a two horse race.

Then, in what seemed a desperate downward leap, the Wii was launched into a different trajectory. It addressed non-consumers with a new, more intuitive controller and standard resolution rather than competing for hardcore gamers with more power and richer graphics.

5by5 | The Critical Path #30: Jetlag

5by5 | The Critical Path #30: Jetlag.

The thirtieth Critical Path is an extended edition covering a broad sweep of topics: The new iPad and the value of filling the gaps, trip report on the Apple Investor Summit, conversations with a TV show writer, Tim Cook’s attack on the cash mountain and an update on Asymconf. Horace also talks about his cure for jetlag.

Estimates for Apple's second fiscal 2012 quarter

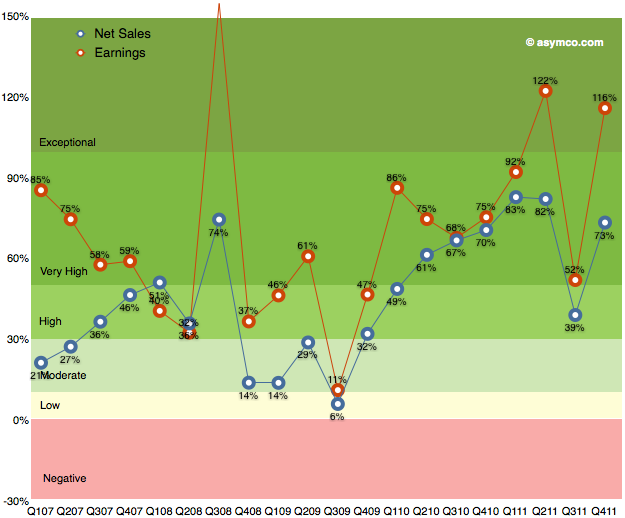

As the chart below shows, the last quarter (fourth calendar 2011, first fiscal 2012) was robust with 116% earnings growth and 73% net sales growth. I’ve heard many superlatives used to describe it. It is certainly exceptional but it was not as good as the second calendar quarter of 2011.

Sales grew faster both in CQ1 and CQ2 of 2011 and earnings grew faster in CQ2. It was in many ways a return to normality due to the iPhone returning to 133% revenue growth after the lull of the transitional third quarter.

Now it’s time to consider the current quarter. Continue reading “Estimates for Apple's second fiscal 2012 quarter”

Tim Cook's latest promise to Apple's employees

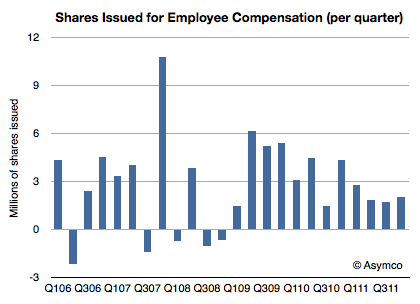

In the recent event discussing Apple’s cash plans, Tim Cook stated that the primary objective of the stock repurchase program is to reduce dilution from the ongoing distribution of shares to Apple’s employees and executives as part of their future compensation.

The amount allocated to this is $10 billion over a three year period.

This sets up an interesting analysis. The company is saying that they will continue to pay employees with newly issued shares (in addition to wages) but that a portion of those shares will be purchased back from the market to reduce dilution.

To understand the impact, it would make sense to look back and observe how many shares were issued in this way historically and consider how much $10 billion buys.

The following chart shows the quarterly change in shares outstanding.

Continue reading “Tim Cook's latest promise to Apple's employees”