Registration for Asymconf opened one week ago and about 42% of the available capacity has been reserved. For those who have registered and those who are considering registration, this is a brief introduction to how the event will be conducted.

The method of presentation and participation was originally designed as a teaching method[1]. What we’re going to do is a very simplified approach of the case method first introduced in the teaching of law and later adapted to the teaching of business administration. The key difference in this method vs. the classic lecture is that there is no assumption that a right answer exists and hence that there is no greater value placed on the lecturer vis-a-vis the audience.

The event is therefore performed by three key components:

- The facilitator

- The case team

- The spectators

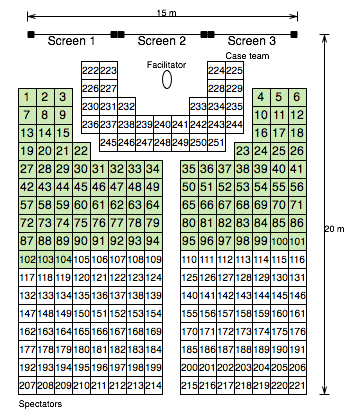

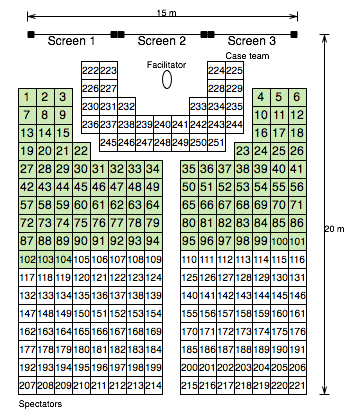

The diagram shows the venue and rough placement of the components (to scale and with reserved seats highlighted in green).

The facilitator’s role is similar to that of a conductor of an orchestra. It’s primarily to help the individual instruments working together but not to make the music himself.

The “music” is primarily produced by the case team. This will be a group of about 30 persons arranged in a semi-circle around the facilitator. They will “debate” a case that will be published as a blog post in advance of the event. They can put forward information, agree and disagree and generally try to uncover meaning or truth.

The case team, like an orchestra, should be diverse. They are not expected to be subject matter experts but to bring their particular expertise to a common problem. In fact, subject expertise in one member can be seen as a problem since it could discourage others from also participating.

The case team will be pre-selected from the pool of spectators and will change from case to case.

The reason we ask your area of expertise during registration is so that we can create diverse case teams, not to assign you to a team that has a particular experience.

Continue reading “Update on Asymconf”