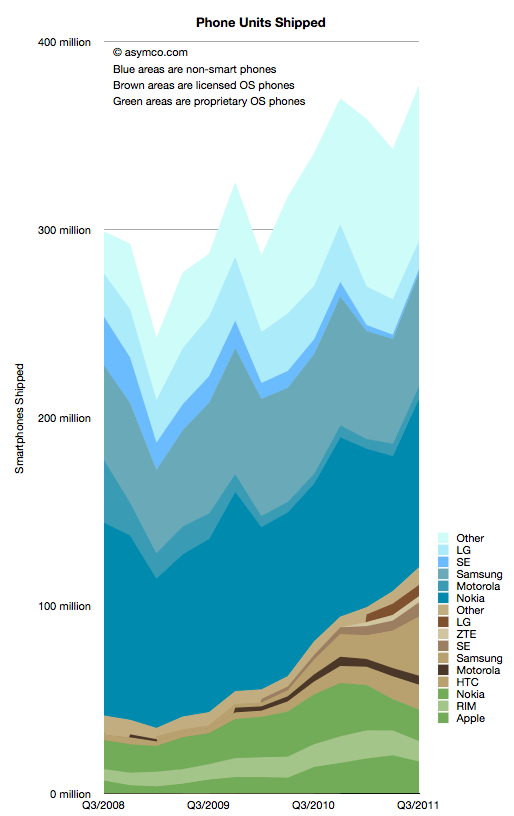

I collected all the data available so far and created a new graph that illustrates the complete market evolution over a three year period.

Apple's Residual Enterprise Value is less than 7x Earnings

In his third “The Critical Path” podcast, Horace Dediu explained how Apple’s cash can be viewed as a strategic option, an opinion that resonated also with other analysts [1]. Cash is one of the most flexible resources as it can convert quickly into other resources such as brands, companies, technologies, people and even processes. More cash means more strategic flexibility. The large cash reserve Apple has accumulated provides high flexibility for future investments. These characteristics of cash already imply an intrinsic option value. But how big is this value?

Calculating Option Value

To help us determine, I will apply the Black-Scholes model. Continue reading “Apple's Residual Enterprise Value is less than 7x Earnings”

Estimating Samsung's smartphone mix

Samsung no longer reports mobile phone shipments. The company’s phone market performance reporting is limited to the following:

Shipment : High-20%↑YoY (low-20%↑QoQ)

ASP : Slight increase QoQ

As the company did not report volumes or ASP last quarter either, the QoQ (Quarter on Quarter) growth estimates are almost useless. The only fragment that might be useful is the “High-20% YoY” given that they did publish units for Q3 2010: 71.4 million. This leaves the question of what “High-20%” means. Here are some ranges and what the result would be:

- 92.1 million assuming 29% YoY growth

- 91.4 million assuming 28%

- 90.1 million assuming 27%

Assessing the Smart TV Opportunity

There has been increasing chatter about a new TV being developed by Apple.

My opinion on the subject was summarized in the post called Tele Vision. I contend that a TV cannot be smart until the content it delivers becomes smart. The logical conclusion is that the value chain needs re-integration so that the component which is not good enough (the content) can be improved along the dimensions that users value. And it cannot be improved unless the direction it needs to go into is aligned with the direction of the disruptive innovator. I won’t repeat the theory here, but it suffices to say that whatever will change television will do so by re-defining the core product not just the tools we use to consume it.

But today I wanted to address another question: how do we value the opportunity? In a back-of-the-envelope manner, can we tell if this business is big enough to try to fix.

The answer depends a lot on the business model of the disruptive entrant. The entry could depend on software or advertising or hardware or distribution, and each would have a different valuation.

But for the sake of calibration, I want to start with a proxy. The basic question of how many “terminals” exist to the value networks. How many units of TVs are sold and how many could a new entrant convert to a new paradigm?

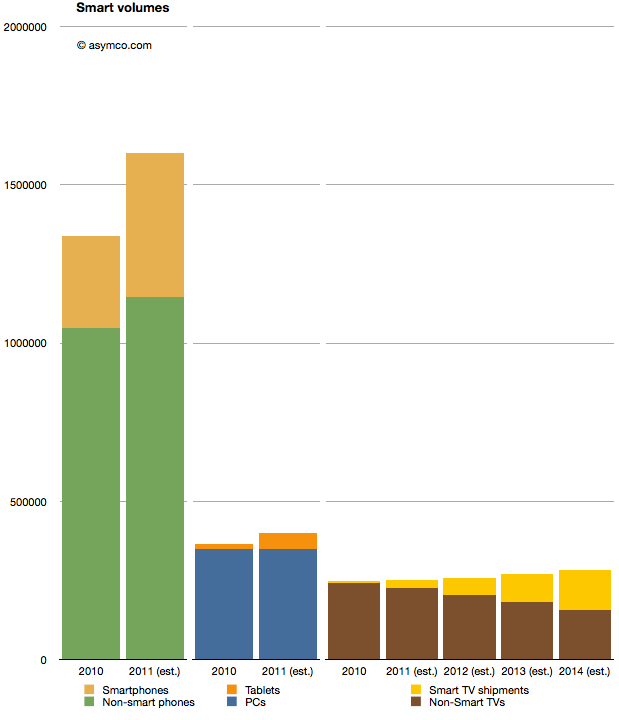

I prepared the following chart showing the world-wide TV market with a highlighted subset of so-called “smart TVs” (source TRi). The market is shown from 2010 actuals through 2014 estimates. To make it more interesting I also added similar data for two other markets. Mobile phones and PCs with their own sub-categories of smartphones and tablets as equivalent “high growth” opportunities.

When considering the opportunity, the Smart TV volumes are small relative to either tablets or smartphones. Continue reading “Assessing the Smart TV Opportunity”

The tipping hand of production: How Apple foreshadows iOS volumes

Prior to the third quarter earnings report I discussed a part of Apple’s balance sheet related to tangible assets (Plant, Property and Equipment). In a series of three posts I covered the Land and Buildings (data centers and campuses), Leasehold Improvements (store investments) and Machinery, equipment (tooling and factory equipment as well as servers.)

The data shows that there is a consistent pattern of investment in pursuit of strategic goals: extending reach into distribution through stores, extending services through cloud infrastructure spending, and extending control over the supply chain. One story that still remains largely untold is how much does Apple know in advance what it will spend.

In other words, can we tell if Apple can anticipate demand and does it plan its expansion well in advance?

For an answer, the 10 K report comes in handy. Published only once a year, this document shows some data that is not present in any other public release. For example, Apple makes forecasts for capital spending.

But first, an update.

Continue reading “The tipping hand of production: How Apple foreshadows iOS volumes”

5by5 | The Critical Path #11: The Thermonuclear Option

Episode #11 • October 26, 2011 at 12:00pm

Dan and Horace talk about patents and litigation as a means of defending innovation. We go way back to the beginning of the last century and talk how patent wars have played out in the past and how they affected the fortunes and fates of innovators.

This episode is sponsored by Squarespace and TinyLetter.

—

IMPORTANT: I made an error in claiming that Mauser litigated for royalties during WWI. The litigation with Mauser preceded the war, but the bullet design used in the rifle was the subject of litigation before, during and after the war. The story of that patent fight is described here: The Tale of the Spitzer Bullet Patent Lawsuit | asymco

To read more about the Wright Brothers patent war see: The Wright brothers patent war – Wikipedia, the free encyclopedia

The other tablets

Analysts have to count things in order to measure value. It sounds easy but it can be tricky. As I pointed out with PCs vs. iPads, if you count an iPad as a PC you can get into a lot of trouble with your clients. But if you don’t you end up directing them away from confronting an existential threat. Only very rarely is a market report published in contradiction to widely held sustaining beliefs. More often than not analysts bow to the source of their paychecks and in so doing show their rear end to the truth.

This comes up again now with respect to how to count tablets. Consider that there is little difference in architecture, software or design between an iPhone and an iPad. They run the same OS, use the same microprocessors and have similar communication methods, inputs and sensors. However they are considered completely different products and counted as part of separate markets. The only physical attribute that differs is the screen size. So we have to conclude that the size of the screen is a huge determinant factor in deciding whether a product is a tablet but not a smartphone (or music player).

But what about tablets themselves? Their screen sizes vary widely. A 10″ screen is certainly a tablet device, but a 4″ screen certainly isn’t. Where is the boundary exactly? Continue reading “The other tablets”

A tale of two disruptions

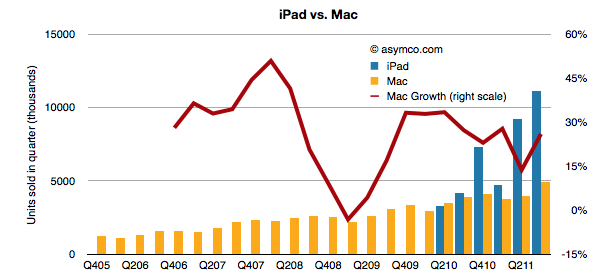

Last quarter the iPad had unit growth of 166% with revenue growth of 146%. The iPad is selling more than twice the (also rapidly growing) Mac. The two product lines are shown below:

Putting capital to work

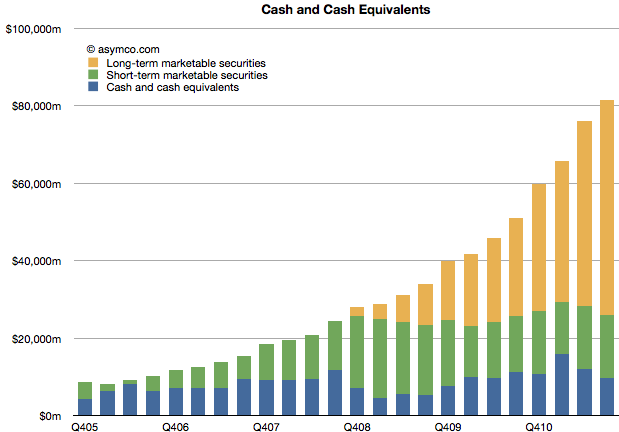

Apple’s Cash and Marketable Securities has been the focus of attention for many year now. It has now reached $81.6 billion equivalent to a value of $86.8 per diluted share. Currently each share is worth about $393 making the enterprise value $306/share or 11 times last twelve month’s earnings.

The division of liquid cash and cash equivalent asset types is shown in the following chart.

The company added $5.4 billion to its cash reserves during the quarter and now keeps two thirds of that outside the US. Long-term securities (bonds mainly) are now Continue reading “Putting capital to work”

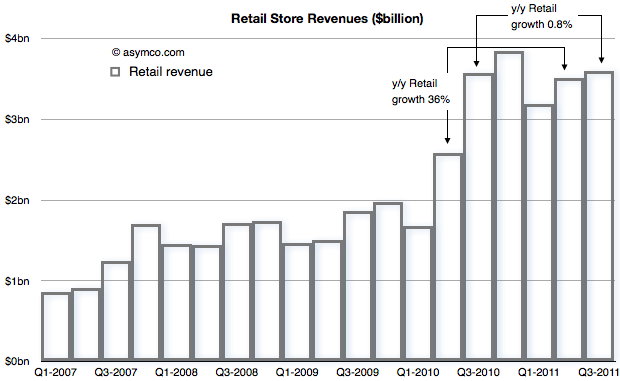

The growth surprise in Apple retail

In Apple: For What It’s Worth Jeff Matthews asks a question “about the most disturbing pattern coming out of Apple’s earning release: the measly 1% year/year revenue increase at Apple’s retail stores”.

He notes that prior to the drop, Apple stores were growing at 36%. Such a huge drop quarter on quarter seems suspicious and he thinks something is happening.

Something is happening.

To find out what, let’s start with the revenue from Retail that Apple reports[1]

The concern is with that low growth between calendar Q3 last year and this year. That is being contrasted with the growth in the previous quarter (Q2) of 36%.