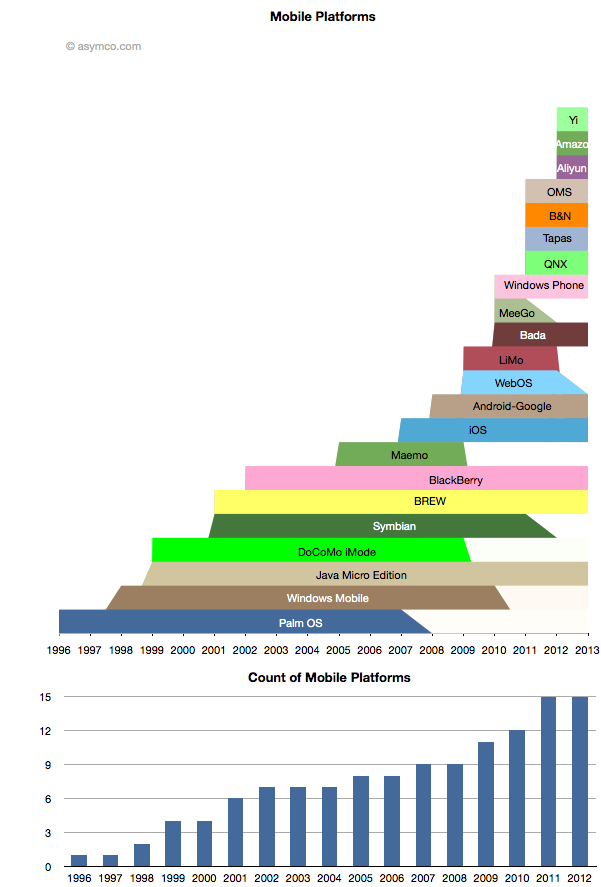

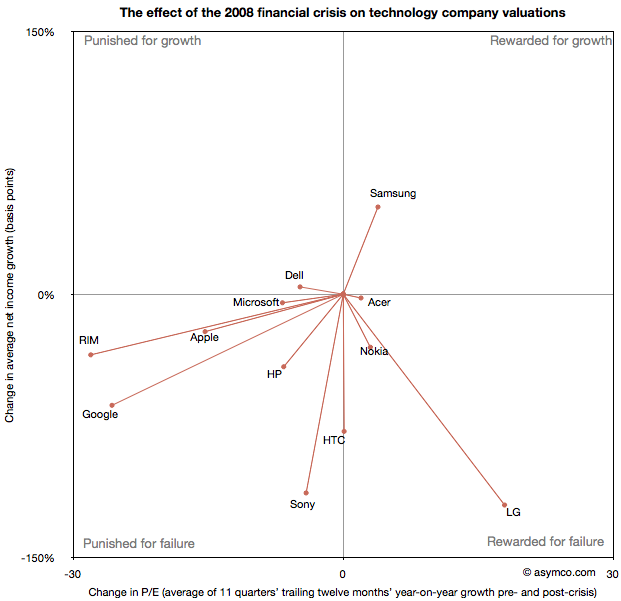

After processing more than 1500 data points on the performance of thirteen technology companies, patterns are beginning to emerge. The steps so far:

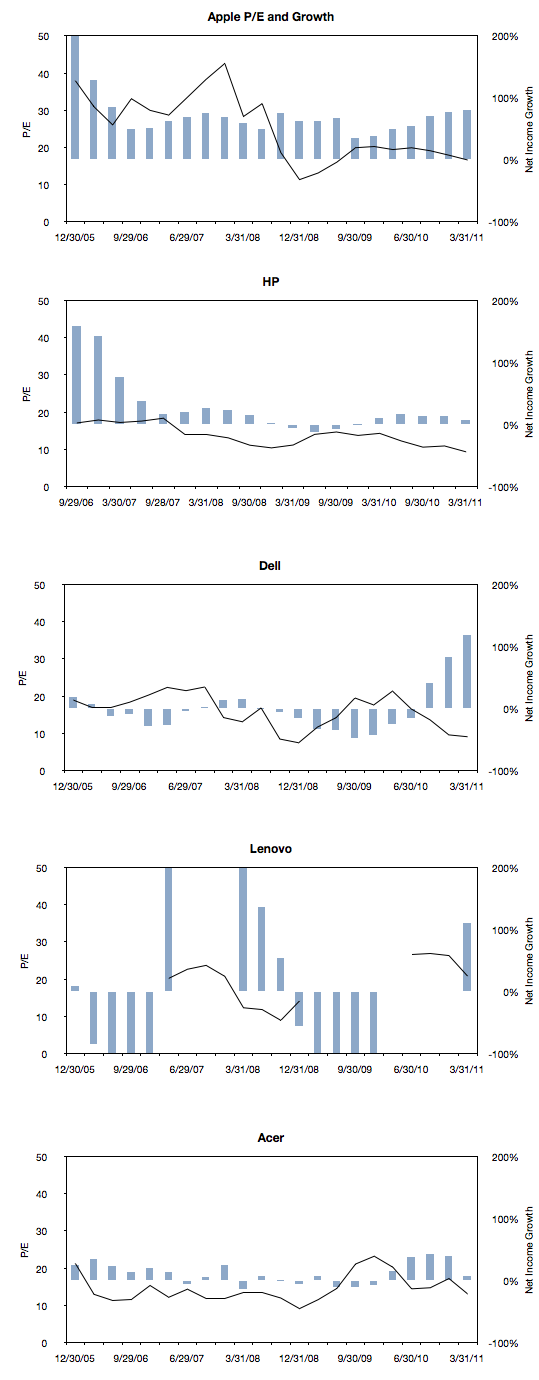

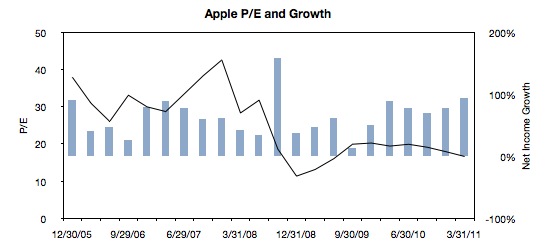

- Visualizing P/E and Growth as time series centered on a point of crisis.

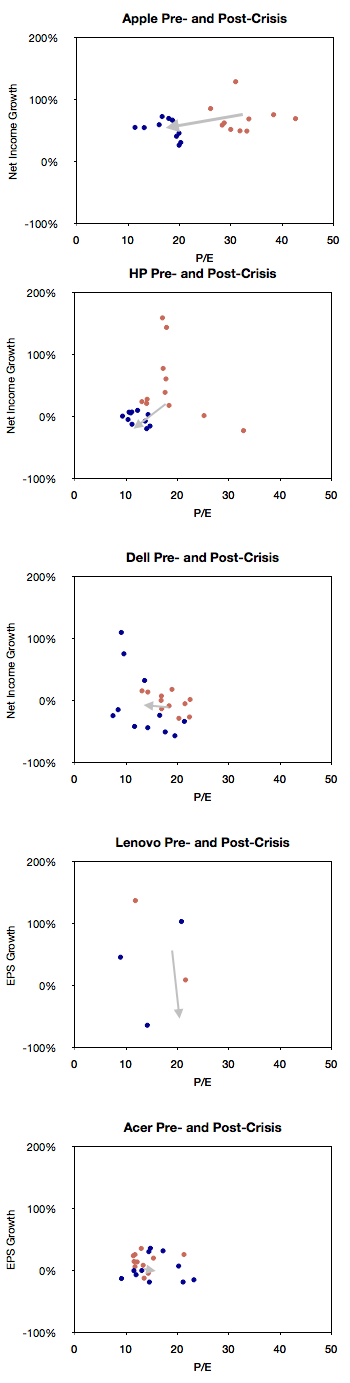

- Plotting P/E vs. Growth with an eye toward any clustering/correlations for the cohort.

- Detecting and measuring any change in the relationship between P/E and Growth before and after the point of crisis.

The final step is to plot the changes in the relationship between pre- and post-crisis for the set of companies normalized to the same starting point and then classifying them:

The chart shows how the “average P/Es” changed after 9/30/2008 vs. how the companies performed during those periods. An evocative categorization is suggested for the four quadrants.

One way to read the data would be as a degree of effect of the crisis. Continue reading “Growth and punishment: The vector space model”