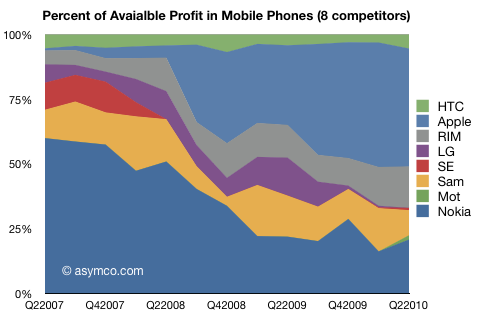

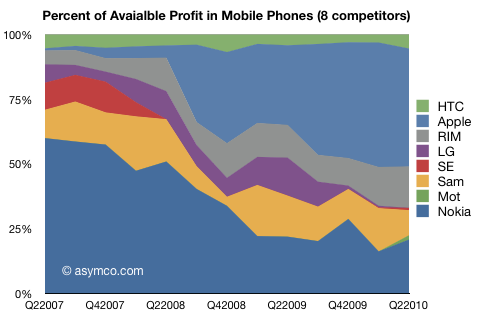

A quick update on the analysis of mobile phone profits. If the available profit[1] (i.e. excluding losses) were summed and each vendor’s profit were measured as a percent of this total, this chart would tell the story of the last three years:

Note that profit share has mostly shifted from Nokia to Apple, though Sony Ericsson and LG were also casualties and Motorola has not had anything to lose.

Some assume that the future belongs to the Koreans but we see that the relatively small amount of profit that Samsung has (less than RIM actually) has not changed much. HTC is also shown to be a steady performer but not having displaced much from competitors.

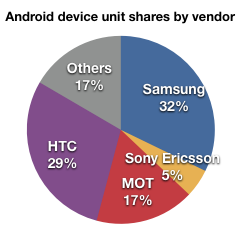

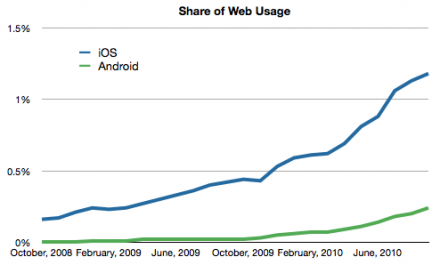

Will Android change this picture? As I’ve argued before, Android is most attractive to the unprofitable and the strategically constrained. Can having undifferentiated new products change this? As Nokia is unlikely to license Android, and RIM seems very unlikely and Apple is out of the picture, the only possible contenders are Samsung, LG, HTC, Motorola and Sony Ericsson.

Motorola and Sony Ericsson have both returned to profitability but with a very small volume Android strategy. However the incumbents fielding Android are really facing a far more sinister threat: the smaller local brands in China (e.g. ZTE) and emerging markets.

On profitability, the smaller challengers are unlikely to make a large impact, but they will constrain the profits of other licensees. The distribution of phones on a global scale is challenging without a brand, and brands are very expensive to build. It’s still possible over a longer timer frame that a small brand like HTC can emerge on a global stage. But in terms of profit capture, challengers will mostly “steal” from the already constrained big brands running with Android.

—

[1] Profit is not the only measure of success and can sometimes be a deceptive indicator. For this reason I look at a longer time frame so that anomalies, seasonality and business cycles are smoothed over. As flawed as it is as a measure, the most important reason to pay attention to profit is that it’s the only fuel for growth in the long term. Companies that are consistently unprofitable (e.g. Motorola) face diminishing degrees of strategic freedom further lubricating a downward slope toward financial distress.