We expect revenue to be about $18 billion compared to $12.2 billion in the September quarter last year. We expect gross margins to be about 35%…

We are targeting EPS of about $3.44.

via Apple Inc. AAPL Q3 2010 Earnings Call Transcript.

That $18 billion figure is extraordinary. Consider that last year during the same quarter, the company received $12.2 billion, then the sales growth forecast is about 50%. Granted that even though Apple just achieved 61% sales growth last quarter, Apple management is unusually aggressive in underestimating.

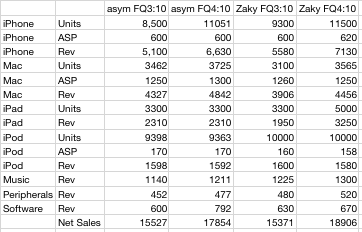

Given this, I am looking at the following forecast:

- iPhone units: 12.2 million (65% growth)

- Macs: 4 million (30% growth)

- iPads: 3.3 million (flat sequentially, production constrained)

- iPods: 9.4 million (-8% growth)

- Music growth: 26.7%

- Peripherals growth: 21%

- Software growth: 8%

- Total sales: $19.0 billion (56% y/y growth)

- GM: 42.3%

- EPS: $4.78 (73% y/y growth)

If this estimate proves correct, then at the end of the quarter (Oct 1) the trailing twelve months’ earnings per share will be $15.29. That is equivalent to P/E of 16.82 on the back of four quarters of earnings growth (47%, 86%, 75% and 73% respectively). The price/earnings excluding cash would be 13.4.