8:50 am: Walt circles back, notes that Ballmer uses the term PC to include things that most people don’t think of as PCs. Is the iPad a PC?

Ballmer: Of course it is. What do you do on it? Answer email….A guy tried to take notes on it at a meeting I was at yesterday–that was interesting [chuckles from the audience]. He suggests that the positioning of devices like the iPad as something beyond the PC is just a marketing tactic.

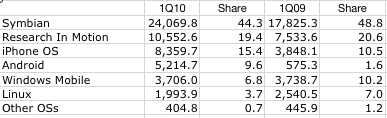

If only the analysts would add the 2+ million iPads shipped this quarter to Apple’s Mac units and declare that Apple’s market share doubled(*). If only things were so simple.

At least on this I agree with Ballmer.

(*) The iPad is already outselling the Mac on a weekly run-rate.