The most impressive number for us is the change in units shipped. For example, leader Nokia held 66.6% of the marketshare in Q1 of ’09, and 45.2% in Q2 for a 7% change in units shipped. Meanwhile, Apple held 10.2% in Q1 ’09 and 40.3% in Q1, ’10 for a 532.1% change in units shipped.

Tag: iPhone

Can the iPhone reach 10% of the world's 3G subscribers?

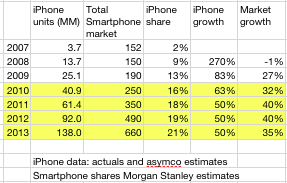

In a previous article I asked what it would take for the iPhone to reach 20% of the world’s smartphone market? (answer: 50% growth).

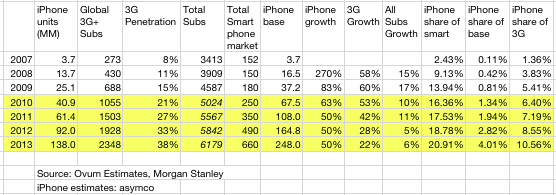

Now I take a look at the whole market measuring three underlying quantities:

- the number of total wireless subscribers world-wide

- the number of 3G subscribers

- the number of smartphones sold every year 2007 to 2013

The forecast for 2013 is:

- total subs: 6.2 billion

- total 3G subs: 2.4 billion (38% of all WW users)

- 660 million smartphones sold in 2013

I also computed the installed base of iPhones based on units sold per year according to the following schedule: 100% of iPhones in use during first year, 75% in use after second year, 50% in use in the third year, 25% in the fourth and 0% in the fifth and after.

If the iPhone can sustain 50% growth then the following are possible in 2013:

- 4% of world’s users using an iPhone (248 million iphone users)

- 10% of 3G users are using the iPhone

- 21% of smartphones purchased are iPhones

Can iPhone reach 20% of global smartphone market?

On a yearly basis, iPhone has been growing at 270% in 2008,83% in 2009 and 130% so far this year. The growth has been faster than the growth of the smartphone market during the same time. As a result, the market share of the iPhone has increased from 2% in 2007 to 13% in 2009.

The question now is: What is the required growth rate for iPhone to maintain growth in share as the overall market grows?

Taking market estimates from Morgan Stanley, I tried to fit an iPhone growth rate which would result in a 20% share for Apple by 2013. This rate turns out to be a conservative 50%/yr. Any growth beyond 50% would result in well over 20% share for the iPhone.

The iPhone at three

The end of June will mark the third anniversary of the market release of the iPhone. When it arrived in June 2007, anticipation for the product was significant with high consumer awareness and expectations–though the 10 million/yr. target for 2008 was met with skepticism by many.

The iPhone launched on June 29th 2007, with only a few days remaining in the quarter. 270k units were sold in that quarter and that was considered a solid start. When the company reported earnings a few weeks later (July 18th 2007) the company’s stock price jumped to $140 a share.

As a sign of optimism in the company’s prospects, the P/E ratio showed that the company was expected to reach 35% growth (35 P/E).

Was this optimism warranted? Continue reading “The iPhone at three”

Prepare for unrestricted iPhone distribution

I’m picking up all kinds of signals that Apple is about to let loose with a storm of operator distribution deals.

It all started with Tim Cook’s comment in the last conference call:

Over the past year we have moved a number of markets from exclusive to non-exclusive. In each case as we have done that we have seen our unit growth accelerate and our market share improve

Now we are hearing of unrestricted iPhone distribution in France and today the rumor of T-Mobile picking it up in the US (which I always thought was more logical than Verizon). There are other hints from the Nordic countries

Three to Carry iPhone 4 in UK | News | The Mac Observer observes that there will be five (!) UK carriers selling it.

In addition to the super-steep ramp of 88 countries launching in 3 months.

It looks like Tim pulled all the stops.

40 percent of US iPhones are sold to enterprises

Four out of 10 sales of the iPhone are made to enterprise users. When the iPhone came out, what most people heard in the first year from ‘07 to ‘08 was oh my God, it’s not BlackBerry secure. This is not going to work on the enterprise space.

At the end of the day, it’s just software. That’s all it is. And by the time the 3G came out in ‘08 they had solved about 80% of the security issues.

So enterprises today view the iPhone as a mobile computer. It happens to have a voice application on it.

via AT&T exec: 4 out of 10 of our iPhone sales to enterprises | ZDNet.

Compare Apple’s approach to that of Nokia: Continue reading “40 percent of US iPhones are sold to enterprises”

Does iPhone really have 72% of Japanese smartphone market?

MM Research does not count Symbian as a smartphone platform. This makes them inconsistent with any other analyst for counting smartphones. So shouldn’t Symbian be included?

In a comment to iPhone has 72% of Japanese smartphone market | Asymco it’s been pointed out that 12 million Symbian sold in the same time frame as Apple sold 1.7 million phones in Japan.

It would seem then that the correct market share for iPhone would be 12%, with Symbian having 83% and “others” having less than 5%.

However…

Symbian in Japan is not the same thing as Symbian elsewhere. Symbian in Japan is used as a low level OS by Fujitsu, Sony Ericsson Japan, Mitsubishi, Sharp and others to provide devices running the MOAP(Symbian) software platform. MOAP (Mobile Oriented Applications Platform) is the software platform for NTT DoCoMo’s FOMA (Freedom of Mobile Multimedia Access) service.

Unlike Series 60 and UIQ MOAP(Symbian) is not a open development platform.

MOAP is also supported by Linux with Panasonic and NEC using it in something called MOAP(Linux).

MOAP(Linux) is also not an open development platform.

So the “72% share for iPhone” in Japan must be stated with this important caveat: that Symbian and Linux are not included because, due to not having exposed APIs, they are classified as feature phone platforms.

Apple's iPhone replaces Blackberry

British bank Standard Chartered is replacing the Blackberry, currently its standard corporate communication device, with the iPhone.

The process of migrating corporate email services from the Blackberry to the iPhone started about a month ago, said the spokeswoman, although she did not know how many of the Asia-focused bank’s 75,000 employees used company-issued Blackberries or when the switchover could be completed.

via Apple’s iPhone replaces Blackberry for some bankers | Reuters.

I remember reading once that the iPhone was not suitable for Enterprise use.

Misdiagnosing Failure: Why Disruptive Innovation Models Miss on Apple

In a thought-provoking article in The Motley Fool (Predicting Failure: Testing the “Disruptive Innovation” Model ) summarizing recent research in disruptive innovation, the following quote jumped out at me:

Then again, the model is dead wrong 15 percent of the time. Lest you think Thurston won’t admit to failures, he points out several instances where his own predictions are wrong. Take the Apple iPhone, he says — if you apply the model to this specific product, instead of the company as a whole. Apple was a new entrant in mobile phones. The iPhone provided better Internet performance and a better interface at a higher cost — not poorer and cheaper — yet it was very successful from the start. “When it’s wrong, it’s interesting,” Thurston says. “We hope to improve the theory.”

This is of particular interest to me because I’ve always felt that Apple had a disruptive track record that was not recognized by disruption theory practitioners. I think the reason is that casual observers place Apple’s products in narrow categories rather than seeing the real jobs that the products are hired to do.

The reason iPhone gets misdiagnosed by disruption theory is that it is placed alongside other phones and looks sustaining. That’s what the quote above implies and it’s a common mistake. I first did that myself. However a cursory review of how the product is used (see ComScore and Nielsen surveys on usage) shows that it’s used for browsing and applications more than for mobile telephony. These jobs it’s hired to do have more in common with personal computing. Therefore, when you put an iPhone next to a computer, its disruptive potential becomes clear. This placement also leads you to think of a trajectory that predicts the iPod touch and the iPad as natural improvements for Apple.

That is why I classify the category the iPhone competes in as Mobile Computing–a category of products that is undoubtedly disruptive (less powerful but more convenient and often cheaper) vis-a-vis traditional personal computing.

Similar analyses for the iPad, the iPod would also reveal a pattern of new market disruption for Apple.

Tim Cook on iPhone Distribution: eight new carriers, three remain exclusive, total of 151

You can look at the number of carriers we added which was eight as I had mentioned, and out of the 151 carriers at the country level it is a good number but not a significant number. Obviously the existing carriers performed very well in addition to the adds.

… There are three main countries where iPhones have a contractual exclusive relationship. That is the United States, Germany and Spain. There are a few smaller countries where we have an exclusive or co-exclusive but those three are the ones that are the major markets. Over the past year we have moved a number of markets from exclusive to non-exclusive. In each case as we have done that we have seen our unit growth accelerate and our market share improve. But that doesn’t mean we view that formula works in every single case. I would just sort of reiterate what I did last time that this is how we are learning so far. That is the result we have seen so far. We think very carefully about each of these at the country level to conclude what is in our best interest.

via Apple Inc. F2Q10 (Qtr end 03/27/10) Earnings Call Transcript — Seeking Alpha.